As the market hits new highs it appears traders are beginning to get a little more cautious based on the latest data of fund flows for the Rydex family of mutual funds. As I’ve written before, while sentiment polls are somewhat helpful, being able to watch what investors are actually doing provides a much clearer lens into the mind of the market. Even though the S&P 500 has been moving higher, albeit at a slow choppy pace, it seems both the bears and the bulls are hoping for a pullback but for difference reasons.

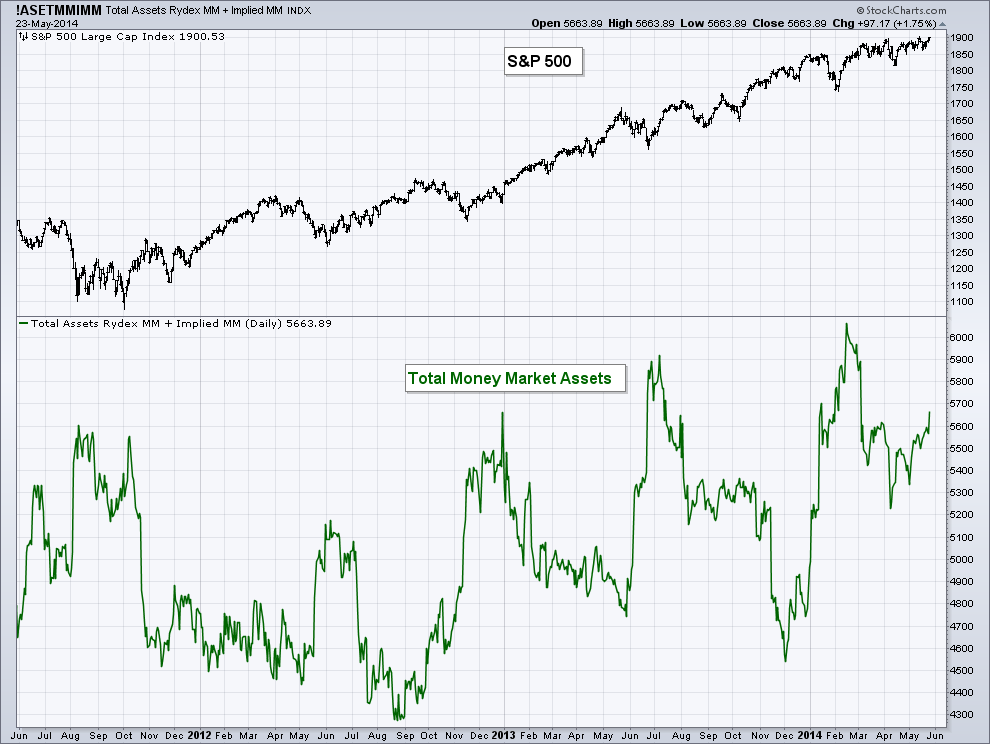

Below is a chart of the Total Money Market Assets at Rydex, as you can see since mid-2012 we’ve seen a slow set of higher highs. It’s important to note that this is a total number not as percentage of total assets, so as more traders add funds to Rydex this figure will rise which doesn’t mean investors are shifting out of stocks or bonds and into cash. What is interesting is to see that off the low in April of this year, the amount of money in money market assets has been going up right along with the equity market.

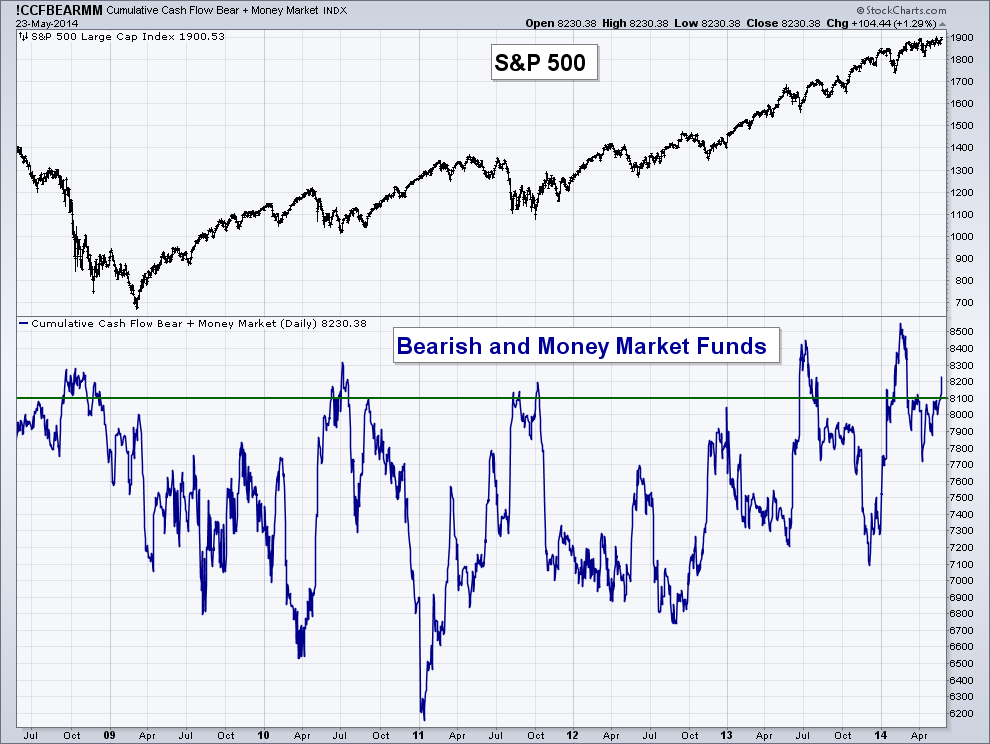

The next chart of fund flows I want to take a look at is looking at the cumulative assets held in the Bearish funds as well as Money Market funds at Rydex. By adding the Bearish fund flows to the chart we can see another view of where investors are putting their money. This chart shows the duration of the current bull market, and as you can see when the cumulative level gets above 8,100 it’s typically marked a bottom in the equity market. This makes sense, as investors run for the safety of cash and try to profit from a decline as they shift to the bearish set of mutual funds – although often at the wrong times. But over the last week or so as stocks have risen we’ve seen this data set rise up to 8,230. Even though stocks are at new highs, assets have continued to steer towards the bearish and money market funds.

The Bottom Line

This seems like one of least trusted rallies we’ve had in a while. Will the pain of being on the sidelines and/or in bearish funds be too much, causing investors to chase the market higher? It’ll be interesting to see what happens.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.