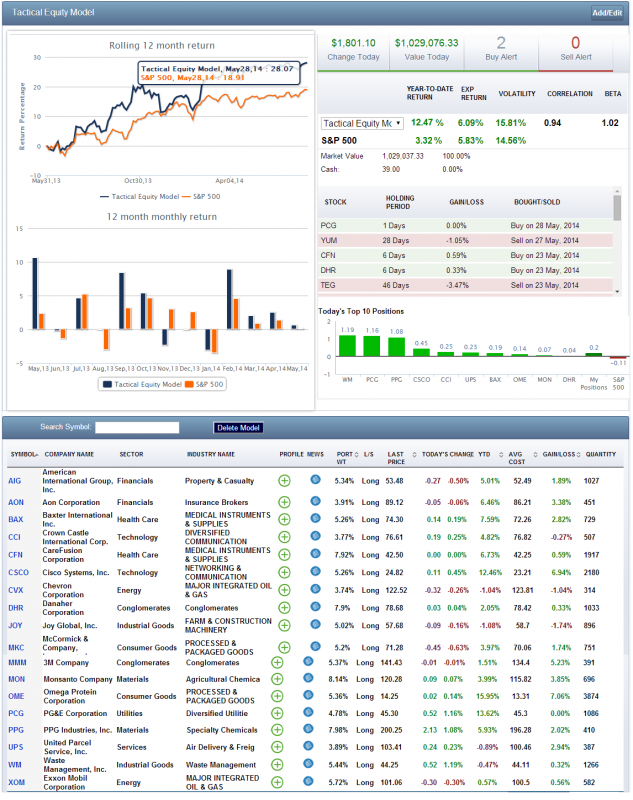

Today we wanted to look at the current stocks that are in ChartLabPro.com’s tactical equity model. Even though the trend for 2014 have been rather weak, the model is up 12.40% vs. the S&P 500 3.4%.

Why Momentum Based Investing?

The reason for momentum based investing lies from two key elements. The first is the ability to pick stocks that are accelerating in price and not a cost of capital and managing upside returns. The second and more important reason is managing downside deviation and asymmetric risk that most long only strategies or fundamental stock picking do not adhere to. By significantly managing downside deviation as a long only manager, this allows the Tactical Equity model to remain in the market as long as possible to capture upside returns without hedging out risk and ultimately capturing greater CARG over a market cycle.

The model is a systematic quantitative program that formulates a view on expected short to intermediate term returns by analyzing the strongest S&P 500 stocks, on a momentum basis. The foundation for our research and strategy: Markets are not always efficient, and by allocating to the strongest 35 momentum stocks, within the S&P 500, we can create alpha while simultaneously minimizing downside volatility and risk.

The momentum based model will dynamically adjust for systematic risk as high beta stocks become crowded and reduce equity exposure. Additionally, the portfolio construction will dynamically change as risk premiums change in the market and rotate into more defensive sectors. The model looks to identify the strongest two stocks in each sector that are not exhausted in price, thus providing the best risk to reward. The average duration of the holding period over the last 20 years is 50 days.

= = =

For more information visit www.ChartLabPro.com