Clearly there is confusion over why bonds continue to be in favor. The TLT (20 yr bond trading vehicle) hit a new 52 week high again today and is not too far off all time highs set in 2012 when rates plunged to near all time lows. Back then, the stock market was not hitting all time highs, but it was making a move toward it. But aren’t bonds supposed to go down when the markets go up?

If the conventional wisdom of the relationship between bonds and stocks seems off kilter, then you would be correct. Nothing is normal anymore, and any old time relationships are no longer valid. For example, gold vs. inflation? Gold has risen without the threat. It appears everything about all markets is a bit confusing, and we can probably lay that blame at the feet of central banks and their activity.

We can have a long discussion over the efficacy, morality and conscious of a loose money policy, but at the end of the day it’s not for us to decide. The goal was to avoid a worldwide depression, or at the very least put off the pain for as long as possible. Nobody knows what the endgame will be amid rampant speculation. Will the Fed be stuck with an enormous balance sheet after tapering is completed?

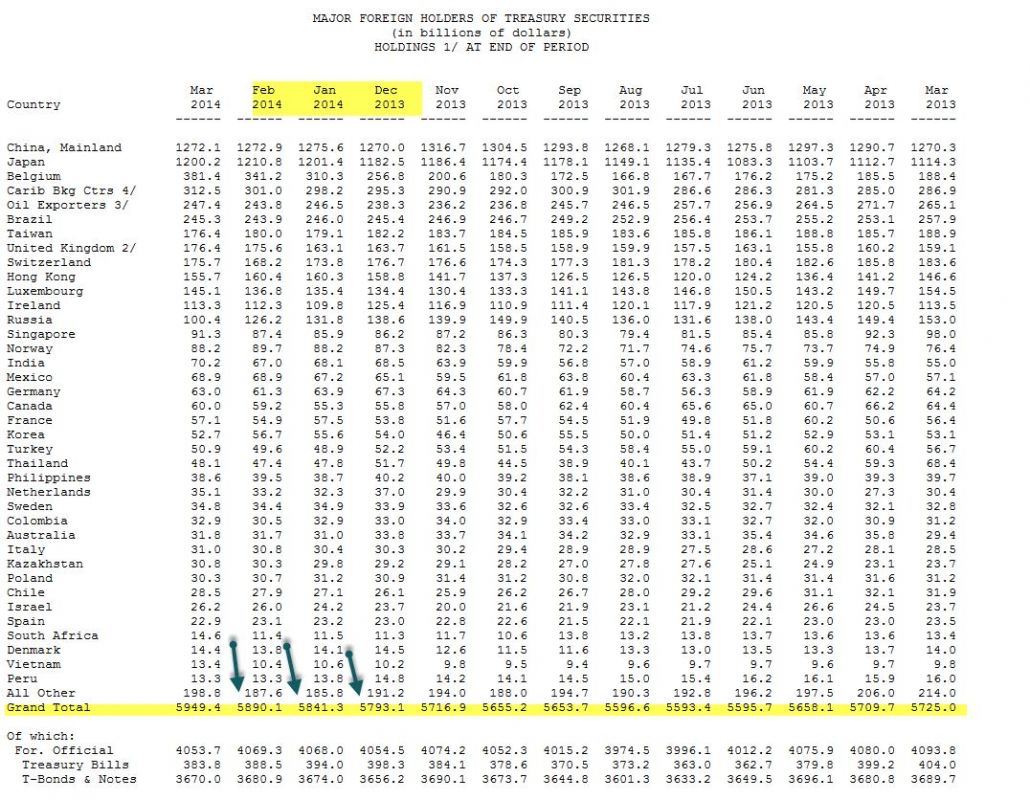

And that leads us back to bonds and to why there is such a hunger for US treasuries. Ever since the AAA rating was stripped in 2011 and the talk was ‘nobody will ever buy our bonds again,’ yields have remained stubbornly low, no higher than 3% and no lower than 1.4% on the benchmark 10 yr bond. The Fed didn’t care, they continued to buy treasuries and even mortgages at a frenzied pace. Further, foreign bond holdings have reached high levels again.

They still do today, though they are reducing purchases gradually. Given the difficulty of managing such a portfolio there are only two ways for the Fed to have a graceful exit – strong demand for bonds or buybacks from treasury. The latter may only be a pipe dream some day but the former is a way out of this menagerie.

Perhaps buyers of bonds today see value and safety in a low yield, the US economy being one of the best in the neighborhood. That may end some day, but perhaps when that day comes bonds will not be so plentiful and rates will be more normal.