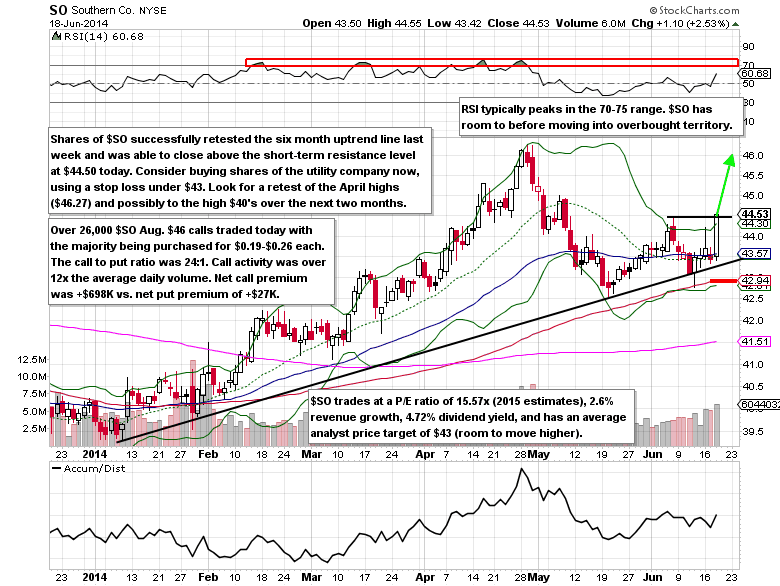

On Wednesday, June 18, there was large call buying in the Consolidated Edison (ED) Aug $60 calls and the Southern Company (SO) Aug $46 calls around 12:30 P.M. EST. Con Edison call activity was 22 times the average daily average (over 10 times for Southern). Given all of the M&A activity this year the utility sector could be the next place for deals to emerge. Regardless, this trader(s) is buying out-of-the-money calls in the August options expiration in these U.S. based utility companies. Both will report Q2 earnings in late July/early August.

Fundamentals

Southern trades at a P/E ratio of 15.57x (2015 estimates), 2.6% revenue growth, 4.72% dividend yield, and has an average analyst price target of $43. This compares to Con Edison’s P/E ratio of 14.59x (2015 estimates), 2.2% revenue growth, 4.46% dividend yield, and has an average analyst price target of $57.50. Both have similar fundamentals, but Southern is the much larger of the two with a market cap of $39.7B vs. Con Edison’s $16.5B market cap.

Southern Company Options Trade Idea

Buy the Aug $45 call for $0.65 or better

Stop loss- None

First upside target- $1.30

Second upside target- $2.00

Disclosure: I’m long the Aug $46 calls for $0.23 each.

= =

Mitchell’s Free Trade of the Day featuring Hertz Global (HTZ)