Shares of the Texas-based oilfield services company, Halliburton (HAL), are up 37.50% year to date.

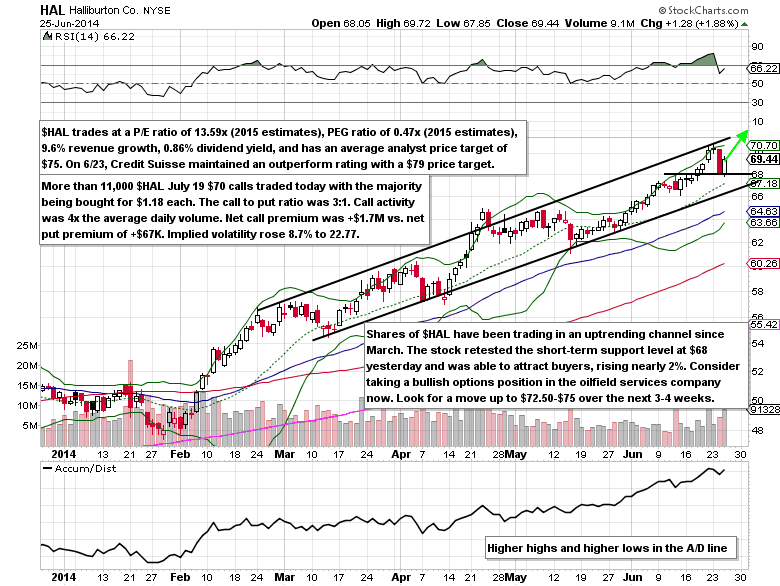

However, the stock still only trades at a P/E ratio of 13.59x (2015 estimates), 9.6% revenue growth, and has a 0.86% dividend yield. The average analyst price target is 8% above the current share price at $75. On June 23, Credit Suisse maintained an outperform rating with a $79 price target (BMO Capital is even more bullish with an $82 price target from April 22). Another positive sign for the overall oil services sector is that the largest by market capitalization, Schlumberger (SLB), announced on June 25th that they expect to grow EPS on a compounded annual rate of 17-20% through 2017 vs. analyst estimates closing to 15%.

Unusual Options Activity

On the same day as the Schlumberger positive guidance outlook, there were three bullish trades in Halliburton options. Someone purchased 2,104 June 27 weekly $69.50 calls for $0.40 and by the end of the day nearly 7,000 traded. The Oct $65/$70/$75 bull call spread risk reversal was put on shortly after the weekly call buying. This involved buying 5,000 Oct $70 calls, and selling 6,250 Oct $65 puts and 6,250 Oct $75 calls. By far the July 19 $70 calls were the most active with over 11,000 trading in the session with the majority being bought for $1.18 (earnings aren’t due out until July 21).

Technical Analysis

Shares of Halliburton have been trading in an uptrending channel for most of 2014. The stock successfully retested the short-term support level at $68 (also has longer-term trend line support around $67). The options market is currently implying a $3.12 move through the July 19 expiration. Given the bullish price action and steady momentum in Halliburton this year, look for a sustainable run into the $70’s over the next month ($72.50-$75).

Halliburton Options Trade Idea

Buy the July 19 $70 call for $1.30 or better

Stop loss- None

First upside target- $2.50

Second upside target- $3.75

Disclosure: I’m long the July 19 $70 calls for $1.25 each.

= = =

Mitchell’s Free Trade of the Day featuring Five Below (FIVE)