For months we have been frightened long-term bulls on the broad equity markets. Back when the S&P500 index (SPX) was trading below 1665 we wrote:

The SPX is now in uncharted territory — literally. It may be approaching a short-term resistance zone around 1666-1658. But, so far it isn’t close to the long-term resistance levels … There’s a lot of room to the upside.

— May 16, 2013

And since then, while we have sometimes warned about short-term pullbacks, we have consistently been calling for an upside target somewhere around 1963-75.

We’re there. Tuesday (June 24) the SPX set a record high at 1968.17, which is pretty close to our target.

What Happens Next?

We are now seeing a disturbing convergence on the long-term chart of the SPX. In our technical analysis we look for three elements to converge: the price, the time and the chart pattern. When all three are aligned, we feel fairly confident in anticipating the next move.

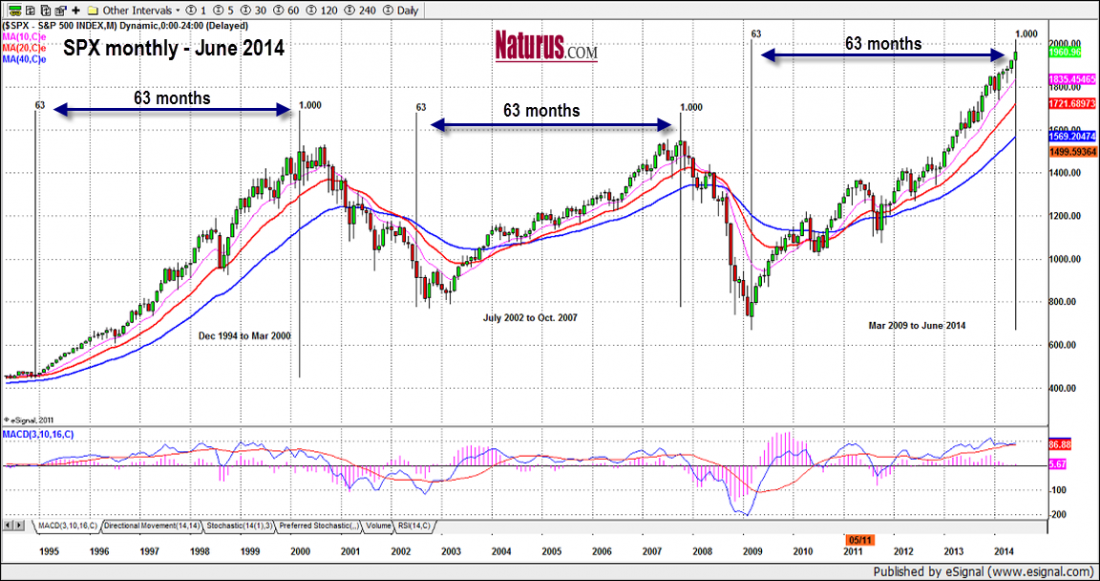

At the moment we think that convergence is not quite complete; but it is definitely developing. The monthly chart of the SPX illustrates the point.

SPX Monthly – 1994-2014

Over the past 20 years there have been three extended rallies in the SPX. The first two lasted approximately 63 months, and were followed by sharp, fast declines that wiped out more than half of the rally profit. The third has now been running for 63 months, and a 50% decline in the SPX would take the index back to around 1300. What was the price when you got on board this Bull?

The two other elements we look for – price and chart pattern – are not yet clear. If/when it gets close to 2000, the SPX will have tripled the price at the 2009 low. There have not been many uninterrupted triples in market history

And we think the current long-term pattern looks a lot like an extended Wave III. That pattern has the capacity to move further than most people believe possible. But it doesn’t go on forever.

How To Trade It

The implications for long-term investors seem pretty clear. It is time to take some profits and head for the exit. You won’t get every inch of the rally; but you won’t be the last guy trying to squeeze out the door either.

For short-term traders like us, we still have to trade the market from both sides. But we have to do it with one eye on the potential for a market top, followed by a big fast bust.

Some short-term trades on the long side will continue to be profitable. But it is like picking up nickels in front of a steamroller. You need to be quick on your feet to do it, and the potential profit is a lot less than the penalty for being slow.