It is important to be aware that George Lindsay admonished his newsletter subscribers that his methods were to be applied only to the Dow Jones Industrials index and not the broader indices. He explained this caveat that using the Dow (“or an even narrower index”) will avoid the constant turn-over of individual components in those broader indices.

= = =

Get Caught Up

Regular readers of this space will remember the column posted two weeks ago, Lindsay Analysis: Bull Market Top in Dow Is Here as well as last week’s column confirming the bearish forecast by showing the positive divergence in the VIX which is expected a market tops.

= = =

Big Picture View

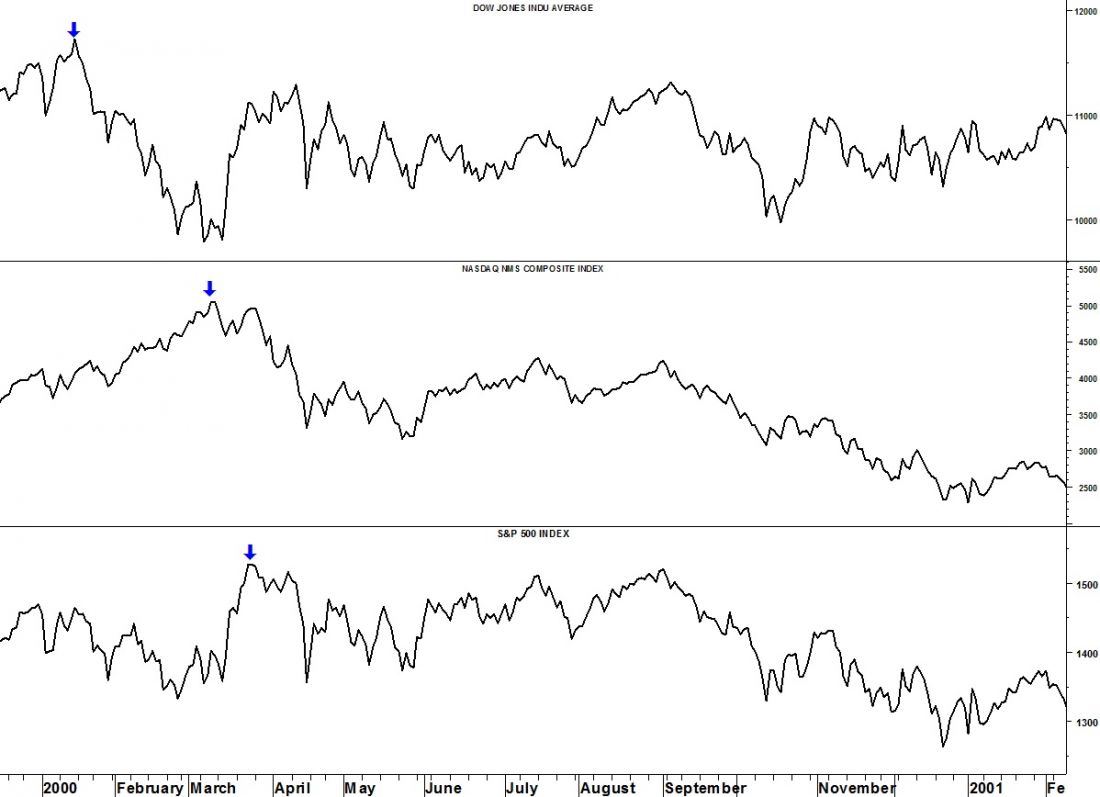

While we have no reason to doubt the Lindsay forecast for an end to the bull market in the Dow during the previous week, a quick history lesson may be in order. At the bull market top in 2007 the Dow and S&P both topped on the exact same day (10/11/07) and the NASDAQ saw its high on 10/31/07. But the bull market which ended in 2000 saw the Dow top on 1/14/00, NASDAQ on 3/10/00 and SPX on 3/24/00. However, in 2000 (unlike 2007 and 2014) there was no 12year interval weighing on the market until July 2002.

Bottom Line

Although the weight of the evidence is bearish, the Lindsay forecast only applies to the Dow. Other indices may rally to higher highs in the next few weeks even as the Dow fails to do so.

= = =