The Royal Bank of Australia (RBA), the Australian central bank, holds a regular schedule of rate decision meeting for many years. Having a predictable schedule on important issue like the bank rate is doing the financial markets and businesses a great service. Everyone who is affected by the rate decisions can depend on the regular updates and plan their actions accordingly. As such, it also created a concentration of money flow reactions that are tradable.

In this article, I am going to show you the three most important trading days every month that you need to know if you want to day trade Australian dollar successfully. As many readers may have figured out at this point, these three trading days are all directly related to the bank rate decision events. The combined net gain from day trading these three days only is as good as many long term strategies trading Australian dollar.

The Regular Schedule Of RBA Rate Decisions And Minutes Releases

RBA holds a monthly meeting on the first Tuesday of every month except January to discuss and decides on the bank rate and related monetary decisions. This schedule has been in place for well over 30 years. From time to time, special meetings are arranged due to emergency but they rarely happens. Hence majority of the market participants know about the schedule and learned to deal with the schedule in their own ways.

On the third Tuesday of every month except January, the minutes of the rate decision meetings will be released. The release of the minutes is a highly anticipated event because the rate decision itself can be straight forward but the reasoning behind the decision can be revealing of the future expectations. Thus, the minutes releases often produce stronger reactions than the rate decision announcements.

The Three Most Important Trading Days Every Month Except January

The first important day is first Tuesday of the month when the bank rate decision is made. Traders often pile on their bets right before the rate decision announcements are made because they have an opinion. The aggregated effect from their actions induces volatilities right after the announcements as many of these speculative positions are stopped out quickly from the reactions.

The second important trading day of the month is not as obvious as the first one. It is the Friday before the first Tuesday of the month. This particular day can be tricky to track. Sometimes it lands on the last few days of the prior month. Sometimes it lands on the first days of the month. On this day, professional traders and size players who prefer not to participate in the rate decision game will either close out their positions outright or at least reduce their exposure. Many of these traders will avoid trading the Australia dollar all together until after the rate decision announcement is made.

The third important trading day of the month is the Monday before the third Tuesday when the minutes is released. Again, speculators with open positions will adjust their positions based on money management considerations. As many traders across different timeframes acting together on the same day, the intraday moves become more pronounced.

How To Trade These Three Important Trading Days

A simple strategy taking advantage of the expectancy is already very rewarding:

1. Day long the Friday before the rate decision day

2. Day short the rate decision day

3. Day short the Monday before the minute’s release

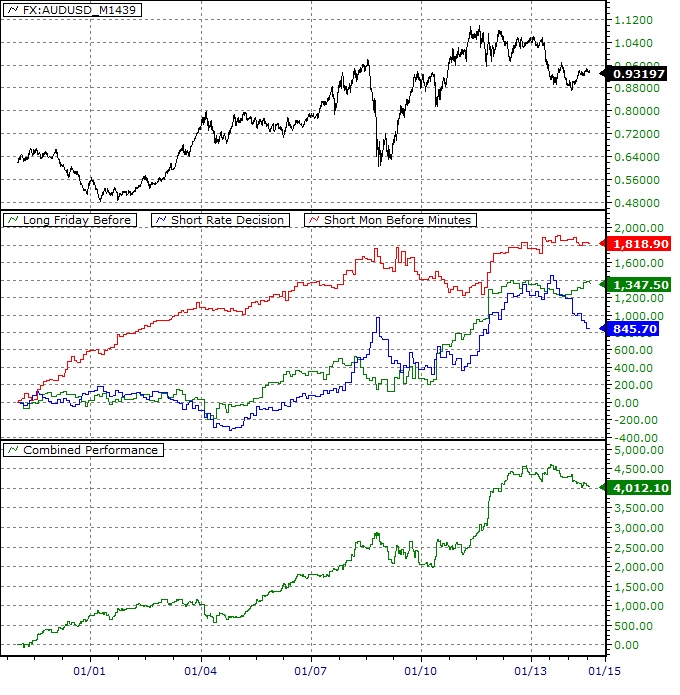

The performance of the strategy in net gain by pips is illustrated in Figure 1. One pip is removed from every transaction (2 pips per trade in total) to account for basic slippage.

The net gain plots in the middle pane of the chart show the performance of the strategy for each individual day.

The net gain plot at the bottom of the chart shows the combined performance for all 3 trading days.

The combined performance of the strategy offers stability comparable to many other long term trading strategies. Yet you only trade 3 days every month except January. It is quite a remarkable edge to lean on.

Characteristics Of The Strategy

The combination illustrates perfectly the old adage, “buy the rumor, sell the news.” The anticipation of the rate decision often leads to directional push sending Australian Dollar higher into the announcement day. On the day of the rate announcement, however, all the fuel has been used up making it more likely to fall and fall hard.

The strategy works well in both rate increase and rate decrease environment. The long and short combinations offset the drawdown of each other producing a stable performance even when Australian dollar has been trending higher most of the time over the past 15 years. In fact, you can see that the short side of the strategy producing more profit than the long side by a wide margin.

One weaknesses of the strategy is dealing with tight range environment. When Australian dollar is trapped in a tight range for a week or two before the rate decision, the strategy will have trouble producing consistent results. Knowing this weakness means you can choose to filter out the trades when Australian dollar is in congestion.

Finally, the strategy works very well in January too. Close examination of the January trading days reveals that the same characteristics exist in January. From what I gather, many people and trading bots probably are not aware that there is no rate decision meeting in January.

Daily Level Bias Is Important In Day Trading

As a summary, the strong biases display in the three trading days related to rate decision are there all along. Yet, majority of beginner day traders are not aware of their existence. Thus, they struggle during these trading days as they assume they are dealing with trading days similar to the other ones. By being aware of the biases on these days, one can at least make better trading decisions if not trading them with ease.

= = =

Lawrence Chan is an independent trader / hedge fund consultant who started his professional trading career as an exchange option trader back in early 1990s. He is known for his research work on market breadth analysis and price discovery process. His website DaytradingBias.com offers trading signals and cloud-based trading tools for forex and index traders. More information available at daytradingbias.com