One of this year’s most highly-anticipated IPOs has been wearable, high-definition camera maker GoPro (GPRO). With the help of high-profile events like the Olympics and a Red Bull Super Bowl commercial featuring Felix Baugartner’s free fall from space, the popularity of these devices has sky-rocketed in recent years. This is evident in the company’s triple-digit and high double-digit topline growth rates. Further, unlike most IPOs, GPRO actually has an established track record of profitability.

Therefore, it came as no surprise that on June 26, its 17.8 million share IPO priced at the high end of expectations ($24 vs. $21-$24), opened for trading 19% above its IPO price, and then soared to nearly $50 per share within its four days of trading.

After its scorching start, however, the stock has cooled off considerably in the wake of its Q1 results. The question now, then, is whether this snap-back has created a new opportunity to enter a position in this compelling company.

Zooming in on GPRO

At this point, most investors are aware that GPRO makes high-performance, wearable cameras that are known for their use in extreme/outdoor sports like surfing, skiing, climbing, etc. The company is the pioneer in the wearable camera market and has become the runaway leader. In fact, according to the company, the top three selling devices were GPRO products with its HERO3+ Black edition generating the most revenue in the market.

Perhaps the biggest concern for GPRO is that competition will inevitably become more of a factor and chip away at GPRO’s growth and margins. Indeed, Sony and Panasonic already offer alternatives and there is bound to be more options hitting the market as technology companies follow the money.

With that said, GPRO may have another ace up its sleeve since the company is much more than just a camera maker. With seven million Facebook (FB) likes, two million Instagram followers, nearly a million Twitter (TWTR) followers, and hundreds of thousands YouTube videos published, it is also a social media company.

The strategy for GPRO going forward will be to monetize that content via advertising revenue. Simply put, the more people that visit a Facebook page with GPRO content on it, the more advertisers would be willing to consider investing in an ad.

Failing to Meet Sky-High Expectations

When GPRO was set to issue its Q2 results on July 31 – its first quarterly results since going public – it was basically set up for failure. The stock had been surging into the print and expectations for a blow-out quarter were escalating.

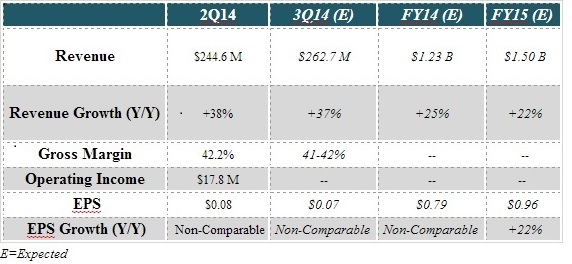

So, when the company merely topped the EPS estimates by a penny ($0.08 vs. $0.07), there was a sense of disappointment as GPRO didn’t match traders’ inflated expectations.

However, if the heightened expectations are stripped away, and investors solely focus on the actual performance, GPRO delivered a solid quarter coupled with strong guidance.

Topline growth of 38% comfortably beat expectations, and, many companies today would gladly take that level of growth. Additionally, gross margin showed continued improvement, expanding to 42.2% compared to 41.1% last quarter. Prior to its IPO, eroding gross margin had been a concern as that metric dropped from 50.4% in FY11, to 43.3% in FY12, and then 36.7% in FY13. But, GPRO has now put together back-to-back quarters of margin improvement, easing those worries.

GPRO also provided impressive Q3 guidance. Specifically, it guided for revenue of $255-$265 million, handily above the $250.9 million consensus, equating to year/year growth of 35% at the mid-point. Also, it forecasted EPS of $0.06-$0.08 versus the $0.04 consensus.

That guidance was unquestionably strong, and when coupled with the Q2 beat, it illustrated that GPRO’s business is still very healthy.

Conclusion: Outlook Appears Picturesque, But Plenty of Risk

If, five or six years ago, someone would have told me that cameras that are mounted on your head will become ultra-popular, and the company that makes them becomes wildly successful, I probably would have laughed. But, there is no question that wearable cameras are red hot right now and GPRO is leaps-and-bounds ahead of the competition.

Could wearable cameras just be a fad, or, will another device someday replace wearable cameras? The answer to both questions could be “yes.” After all, smartphones basically caused the extinction of camcorders.

However, wearable cameras, and GPRO by extension, still seem to be in the early innings of the growth curve. It is estimated that only 8.5 million wearable cameras have been sold worldwide, in total. Apple (AAPL) sells that many iPhones in less than a month.

Further, the amount of content that is shared and uploaded from its devices onto social media networks positions the company to generate advertising revenue, diversifying its business.

The opportunity is compelling, but, investors should be mindful that competition is almost certain to pick up. GPRO has enjoyed market dominance since it first introduced wearable cameras, but, other tech companies will be looking for their piece of the pie.

Wrapping up, I feel GPRO offers a unique growth opportunity and its recent snap-back in shares provides a more attractive entry point. Given the risks, and loftier valuation, a smaller position size may make sense, but, I like the idea of having some skin in this game.

Related Reading

IPO Trading: What You Need To Know —read the story by Dennis Hobein in the Summer TraderPlanet Journal.