When traders first approach the Forex market, they tend to lean towards trading US Dollar based pairs. These include the majority of G8 currencies, as listed below, paired against the US Dollar. While trading the Dollar has its advantages, there are also many opportunities to trade Forex cross pairs. Today we will look at exactly what is a currency cross pair, as well as their trading advantages.

Let’s get started!

What is a Cross Pair?

First off, traders need to understand the difference between “The Majors” and currency cross pairs. “The Majors” are simply considered any of the major G8 currencies coupled with the USD. Examples include commonly traded pairs such as the EUR/USD and GBP/USD. As mentioned above, these are often among the most traded pairs in the currency world. However, they are not the only option for trading!

On the other hand, there are currency cross pairs. A cross pair references any currency quote that does not include the US Dollar. These pairs were developed specifically to ease in the process in which currencies were exchanged. An example of a currency cross would be the EUR/NZD. Notice how this quote is comprised of both the EUR/USD and the NZD/USD (two Major pairs). Traders could create their own EUR/NZD cross by buying one pair and selling another. However, through the use of a cross pair, this transaction has been simplified and potentially reduces costs by not having to convert your transaction to a common USD first.

Currency Cross Benefits

Now that you are familiar with cross pairs, lets look at some of their trading benefits. First off, cross pairs allow you to buy and sell the strongest and weakest currency pairs in the market. For instance If the Great British Pound (GBP) is the markets strongest currency, you would want to couple your transaction against a weaker currency to maximize your potential returns. Now of course you could always buy the GBP/USD and call it a day, but the USD may not be the weakest currency available. Traders may consider buying the GBP/NZD , GBP/AUD, GBP/JPY or GBP/CAD to name a few. This presents an excellent opportunity for trend traders. Through buying the strongest and selling the weakest currency, we can also particpate in some of the markets largets moves!

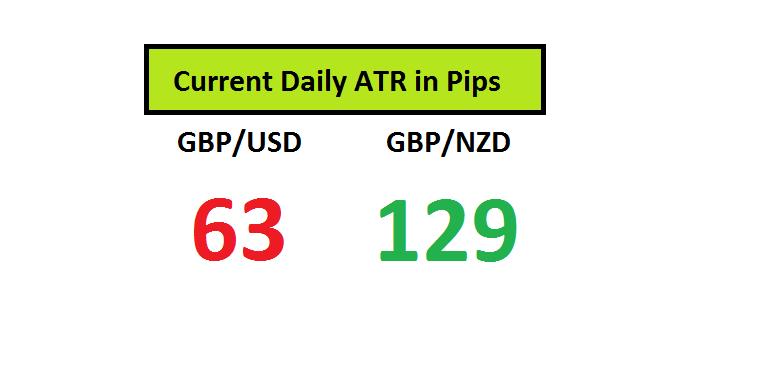

Another reason why traders would consider trading a cross is for their increased volatility. Relative to traditional USD based pairs, some crosses are known to have substantially greater market moves. Certain strategies rely on volatility, and greater market movement can provide day traders and scalpers increased opportunites to trade throughout the day. Below is a side by side comparison of the ATR (Average True Range) for the GBP/USD and the GBP/NZD pairs. Basically, we have measured the average movement for a currency pair in pips. At this point the numbers speak for themselves, as we see that the GBP/NZD moves on average nearly twice as many pips on a daily basis when compared to the GBP/USD. If you are looking for daily volatlility, which would you choose?

I believe at this point the answer to the above questions should be fairly straight foward. There can be advantages to trading US Dollar pairs, but traders should not discount the benefits of currency crosses. By realizing their potential, traders can easily work them into the active trading strategy of their choosing.

Related Reading

If you are new to forex, learn more in this Get Started In Forex Trading series on TraderPlanet by the Daily FX team.