FX trades nearly $5 trillion each day, according to 2013 Bank for International Settlements Triennial Report. Many traders are attracted to the FX market due to this substantial amount of liquidity and the ease of getting into and out of positions.

[Editor’s note: this is part three in a Learning To Trade Forex series by Daily FX on TraderPlanet. Read the previous story here.]

This has led to an increase in popularity of day trading FX. Today, we are going to talk about three T’s for day trading FX. They are:

1. Transaction Costs

2. Technical Analysis

3. Time of Day

(Created using FXCM’s Marketscope 2.0 charts)

Transaction Costs

Since a day trader is looking for smaller movements relative to a swing trader, this means more transactions are made. The brunt of your trading cost is likely to be tied up in the spread of the instrument you are trading. As a result, the major currencies tend to be the marke

ts of choice for day traders because they typically have the tightest spreads and those spreads remain consistently tight through the 24 hour trading day.

Therefore, most traders focus on the EUR/USD, GBP/USD, AUD/USD, USD/JPY, USDCAD and USD/CHF. But don’t forget about other pairs such as EUR/CHF, EUR/GBP, EUR/JPY, EUR/CAD, EUR/AUD, GBP/JPY, AUD/JPY, and AUD/NZD. Though some of those other pairs may have slightly higher spreads in pips, when you factor in the value per pip, their transaction costs are in line with the main pairs.

Day Trading Technical Analysis

Secondly, due to the time sensitive nature of their trades, day traders will rely heavily on the purest form of technical analysis, price action. There is nothing wrong with using oscillators as they can provide some hidden insight to the market’s momentum, but by their nature, oscillators will lag the market. A day trader needs that lag reduced as much as possible, and trading price rather than an oscillator will help.

As a result, identifying levels of support and resistance through chart analysis is a cornerstone to an FX day trading strategy. Horizontal levels based from previous highs or lows, opening ranges, trend lines, pivot points, and Fibonacci retracement levels are all valid ways to identify key support and resistance levels.

Time of Day Matters

The time of day you plan to make and hold your positions matters.

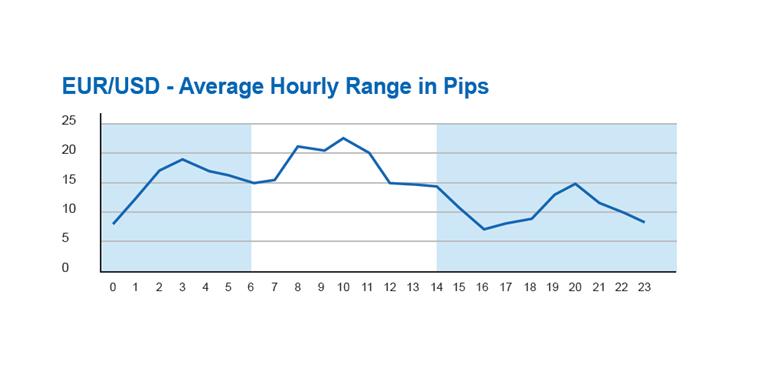

Though FX trades nearly $5 trillion per day, those $5 trillion are not evenly spread out over the corresponding 24 hours of the day. The most liquid time of day is when the London and New York trading sessions overlap. This generally runs between 8am to Noon Eastern Time. The least liquid time of day starts during the afternoon and runs into the early morning hours in the United States.

Liquidity is important because during more liquid times, the volatility in price movements tends to be higher. During less liquid times of day, the volatility of price movements is generally lower. FX volatility dictates your day trading strategy.

According to DailyFX’s Traits of Successful Traders research, we’ve found that implementing a breakout strategy when volatility is high tends to lead to more consistent results. This is because there is more liquidity to push prices through support and resistance levels. So a break of trend lines or horizontal support or resistance is the favored strategy.

*Taken from DailyFX’s Traits of Successful Traders Research. All times are Eastern Time

On the other hand, a day trader holding positions during the afternoon or evening hours will more likely see their levels of support and resistance hold. This is a result of the market lacking the liquidity to break and follow through support or resistance levels. Therefore, the favored strategy when volatility is low is buying at support and selling at resistance.

Good luck!