Traders may be aware of the iron butterfly, a strategy that creates a limit on possible losses, in exchange for a limit on potential profits. Expanding this further, the 1-2-3 iron butterfly is a strategy consisting of three expiration dates and three butterflies.

The middle is a reverse iron butterfly. This structure means that half of the positions will always become profitable whether the stock price moves up or down. And even with no movement, half of the positions – all of the short options – will lose time value and can be closed at a profit or allowed to expire worthless.

This structure – the hedge matrix – also keeps to a minimum the need for collateral. Any uncovered short options have to be accompanied by margin deposits, but in the iron butterfly, this collateral is reduced to the net difference between long and short strikes. It’s a combination of bull spreads and bear spreads.

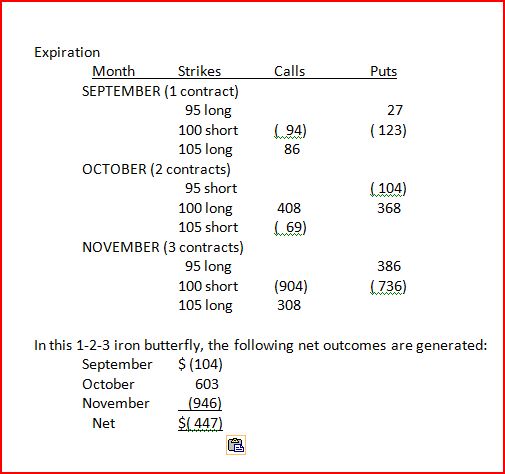

While many combinations of calls or puts, and long or short options can be employed in the 1-2-3 iron butterfly, here is one example:

As of August 26, Exxon Mobil (XOM) was priced at $99.73 per share and reported the following option values (estimated net of trading costs):

The trade generates a post-trading cost credit of $447. If the stock price rises, the long calls gain value, and if it falls, the long puts gain value. Short positions all lose time value, and will lose intrinsic value as well; if the stock price rises, the short puts lose value and if the price falls, the short calls gain. All of these are profitable outcomes for the 1-2-3 iron butterfly.

The “hedge matrix” refers to ways that long and short positions can be matched and closed: With same expiration and different strikes (vertically), same strikes and different expirations (horizontally) or different strikes and different expirations (diagonally). One rule to follow in deciding which positions to close is this:

Never leave uncovered short positions open.

This is important not only to avoid having to post more collateral, but also because uncovered short options add to overall risks. You cover the short with an offsetting long at the same expiration.

Another point to remember: Be especially careful to close or roll short calls in the month that dividends are paid. The most likely exercise date is last trading day, but the second most likely is the days right before ex-dividend date for calls in the money. These are not all exercised automatically, but they can be exercised, so this is a key issue to keep in mind.

As expiration approaches for each of the three sets of positions, you are likely to have a small number of long options remaining open. Short options can be closed at a profit or rolled forward, but long options may be left over. These “orphans” can be handled in one of three ways:

1. Allow them to expire and take a loss. This is acceptable as long as you have accumulated respectable profits on prior positions, and in this case the long options reduce your overall profit.

2. Close at a loss and offset with a profitable close in another expiration. Match the long call with a short option in one of the remaining periods to create an offsetting profit or smaller loss.

3. Close long positions at a loss and replace with new expiration long and short, extending the iron butterfly and creating new net credits to offset your losses.

The example included the first month with one of each strike option; the second month, the reverse iron butterfly, with two of each position, and the third month with three. The same relationships can be established with two, four and six positions, or with three, six and nine options. The advantage of increasing the number of options is that this reduces the trading costs. The more options opened at the same time, the lower the cost per option.

The 1-2-3 iron butterfly is an unusual strategy because with all three expiration months in play, it involves 12 separate positions. This does not mean it is a high-risk strategy, however. As long as you are able to monitor positions and take profits as they materialize, this strategy can work to produce consistent profits with a relatively low level of risk.

= = =

Michael C. Thomsett is co-owner of ThomsettOptions.com, an educational site focusing on strategies for conservative traders. He has also written many options books, including Getting Started in Options (John Wiley & Sons, currently in its 9th edition and with over 300,000 copies sold); Options Trading for the Conservative Investor (FT Press, now in its 3rd edition), and many others. Thomsett is a frequent speaker at trade shows and has taught classes at Moody’s, and lectured at Vanderbilt University and Ohio State University. He lives near Nashville, Tennessee.