Shares of the $92 billion fast food restaurant company, McDonald’s (MCD), are down 0.83% year to date vs. the Dow Jones Industrial Average’s (DJIA) 3.29% gain. From the May high of $102.95, McDonald’s is down 8.06% as comps and quarterly earnings have missed Wall Street estimates in the last two quarters. On August 22, McDonald’s named Mike Andres the new president of its U.S. operations, following July global comps of -2.5% vs. the -1.2% estimate. U.S. comps fell 3.2%, but one bright spot was the +0.5% comps in Europe. This was led by growth in France and the U.K.

McDonald’s trades at a P/E ratio of 15.72x (2015 estimates) with 8.1% EPS growth (0.4% this year), price to sales ratio of 3.27x, and a price to book ratio of 5.72x. Revenue growth is expected to pick up from 1% this year to 2.1% in 2015. The dividend yield is 3.43% compared to the SPDR Dow Jones Industrial Average ETF Trust’s (DIA) 1.97% yield. The average analyst price target is $95.73 (1.14% above the current share price). On August 25, Bank of America maintained a buy rating and kept their $110 price target.

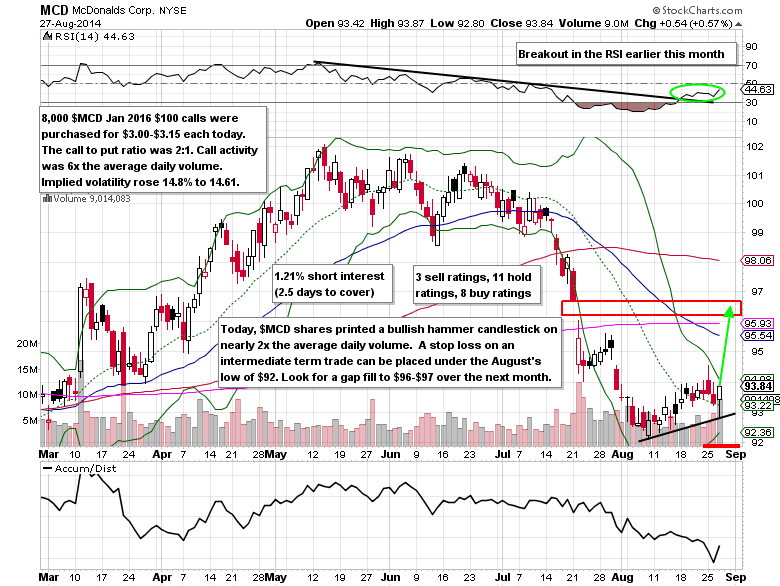

Unusual Options Activity

Options activity has been increasing bullish over the last two weeks in McDonald’s. On August 21, more than 17,000 Nov $95 calls were bought for $1.81 each (tied to a sale of 645,000 shares). This week (August 25th-August 27th) 20,000 Sep 20 $95 calls were bought with the majority going for $0.60-$0.63. On August 27th, 8,000 Jan 2016 $100 calls were bought for $3.00-$3.15 each. Implied volatility rose 14.8% to 14.61 (up 5.8% to 12.72 on the previous day). Whether or not McDonald’s is about to do a deal such as their competitor Burger King Worldwide (BKW) recently did with Tim Hortons (THI), the recent spike in implied volatility combined with the massive call buying sets up for gains in the stock in the near-term.

McDonald’s (MCD) Options Trade Idea

Buy the Sep 20 $94/$97.50 call spread for a $1.00 debit or better

(Buy the Sep 20 $94 call and sell the Sep 20 $97.50 call, all in one trade)

Stop loss- None

First upside target- $2.00

Second upside target- $3.00

Disclosure: I’m long the Sep 20 $94/$97.50 call spreads for a $0.93 debit.

= = =

Mitchell’s Smart Money Report for unusual options activity featuring Bank of America (BAC)