Binary options are becoming more and more popular each day. But are they just a fad, or a serious trading vehicle worth looking into? As a trading coach and trader with more than 15 years experience, I’m always being asked about new markets and new ideas. I must admit that at first I was a bit skeptical about binary options. So I opened a Nadex account and spent a few months evaluating binary options.

In the end I discovered that binary options have merit, and are a perfect complement to the other styles of trading. In fact, I now look for binary options trading opportunities every single day. In this article I’ll share 5 reasons that sold me on binary options, and why you should consider incorporating them into your trading routine if you haven’t already.

1) LOW Account Minimums – As a rule of thumb, I normally encourage traders to start with $5,000 to $10,000 if they are serious about day trading futures. Stock and options day traders need a considerable amount more to trade with. I always stress that traders should only trade with money that they can afford to lose. But the truth is that not all traders have access to $5,000 or more of risk capital. If they do, most traders want to start trading with less. Even serious traders usually want to try out an idea with as little as possible before committing serious capital.

With binary options you can open an account with as a little as $100. Now this doesn’t mean you should open a small account and gamble it away like you’re at a casino. But it does mean that more traders will have access to the binary options market. After putting in the time and effort to create a solid trading plan you can fund an account and start trading sooner.

2) Fixed Risk/Fixed Reward – There’s nothing worse than seeing a long stock position killed with a major gap down. Although stop losses are there to help minimize losses, there’s no guarantee that a stop will get you out of a trade at the price you want.

Binary options help minimize risk because risk is fixed and known before a trade is ever placed. Binaries are often known as “All or Nothing” options because the payout at the option’s expiration will either be $100 or $0. Since risk is fixed and the payout will either be $100 or $0, the max reward of the trade is also known before placing a trade. Fixed reward might appear to be a disadvantage to some traders, but it allows traders to know the exact risk and reward of a trade before a trade is ever placed. This gives you the opportunity to determine if a trade is appropriate for you based on your analysis and risk tolerance.

3) Market Diversity – Nadex (the North American Derivatives exchange), offers binary options on indices, Forex, commodities, and even events! So you’re not limited to a particular market or market group. If you have experience with futures trading, you can get started with binary options on stock indices and commodities that track the underlying futures contracts. If you have experience with Forex trading, you can get started with binary options on currency pairs that are based on the underlying spot price of the pair. And if you have a good understanding of reports, you can even trade binary options on events like Nonfarm Payrolls and the Fed Funds Rate.

4) Flexibility – Nadex offers expirations for both the day trader and the swing trader. There are intraday expirations every few hours, daily expirations at the close of the market session, and weekly expirations that close at the end of the session on Friday. With intraday and end of day expirations you can select the option and expiration that is appropriate for you and your analysis.

5) Simplicity – As far as derivatives go, binary options are as easy as it gets. If a trader believes a market is likely to rise, a trader should consider buying a binary option. If a trader believes a market will drop, a trader should consider selling a binary option.

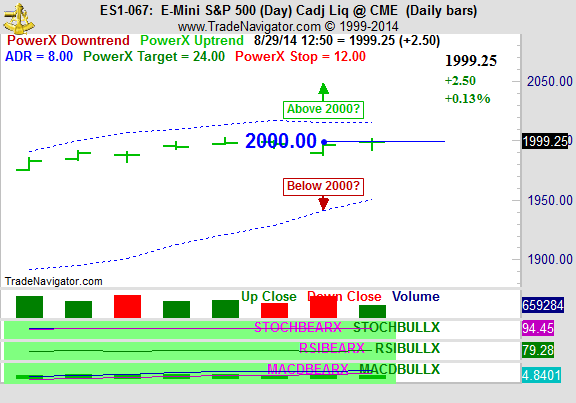

Take the following example of the E-Mini S&P on 8/29/14:

Source: Courtesy of Trade Navigator

Based on your analysis, do you believe that the E-Mini S&P will close above or below 2000 at the end of the day?

If you believe the E-Mini S&P will close above 2000 at 4:15pm ET, you might consider buying a binary option at or below the 2000 strike price. The price you pay for the option is the max risk on the trade. $100 minus the price you pay is the max reward on the trade.

If you believe the E-Mini S&P will close below 2000 at 4:15pm ET, you might consider selling a binary option at or above the 2000 strike price. As a seller, the max reward and max risk calculations are just reversed. The price you sell the binary option for is your max reward. $100 minus the price you sell the option for is your max risk.

Are Binary Options For You?

Binary options are a great trading vehicle for traders that like to trade directional moves but prefer to keep risk fixed. They’re a great fit for both the day trader and swing trader. In my experience they are an excellent compliment to other styles of trading and easy to incorporate into a trading plan. But don’t take my word for it. Consider opening a demo account with Nadex and see if binary options are for you.

= = =

Learn more about binary trading from Rockwell Trading here: www.rockwelltrading.com/binary-special