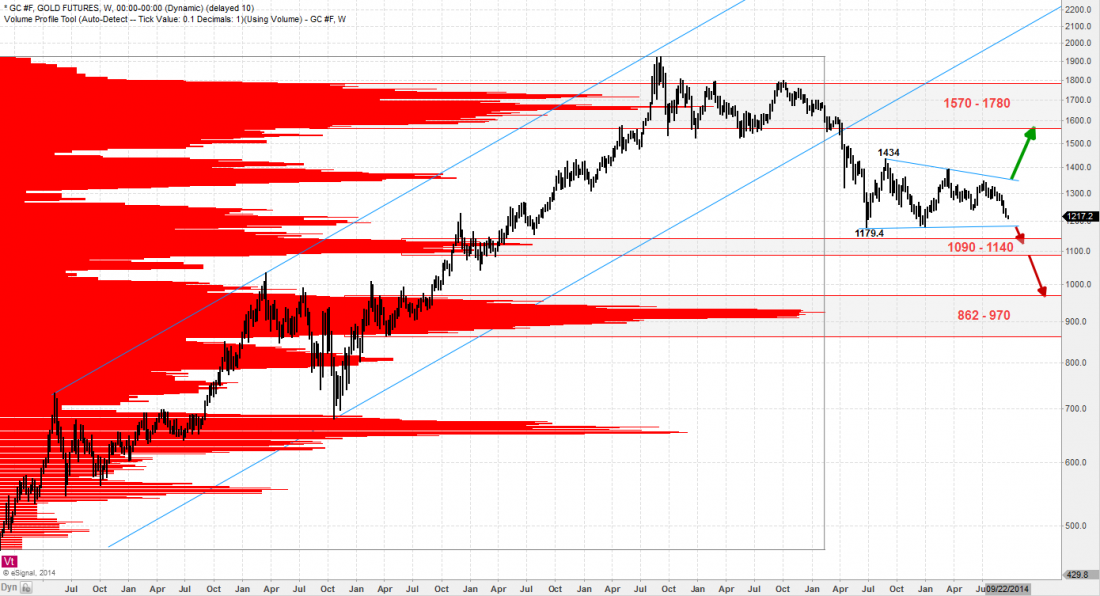

Since the summer of 2013, gold has been tracing out a large consolidation pattern, registering lows at and above 1179 and highs at and below 1434. A break from this consolidation pattern is likely to carry prices to one of the next zones of large degree support or resistance, depending on the direction of the break.

If price continues to move lower, as is the near-term direction, the next lower zone of support is 1090 – 1140. There is additionally a larger zone of support established at 862 – 970 on any substantial weakness (red arrows).

If prices can gain their footing and buyers again step in to buy any sub-1200 dollar prices, a break above the descending trend line (green arrow) and especially 1434 would target a move to resistance at1570 – 1780.

These are big picture zones and a large degree picture that are useful for long-term investors to ensure they stay on the right side of this market.

= = =

To see more analysis from i10 Research and receive a 30-day free trial of our daily and weekly trading reports, visit our page here.