Shares of Burlington Stores (BURL), a $3 billion off-price apparel retailer, are up 24.06% year to date. This compares to the S&P 500’s (SPX) and the SPDR S&P Retail ETF’s (XRT) 8.11% gain and 0.45% decline in 2014.

On September 9, Burlington Stores reported Q2 EPS of -$0.01 vs the -$0.09 estimate (haven’t missed EPS estimates in the four quarters as a publically traded company). Same-store sales increased by 4.7% and gross margins rose to 38.2% from 37.7% in Q2 of 2013. Inventories fell nearly $37M to $711.5M (positive sign for a retailer). They raised FY14 EPS guidance to $1.52-$1.58 from $1.25-$1.35 earlier this year.

The stock trades at a P/E ratio of 18.90x (2015 estimates) with 30.4% EPS growth (69.5% this year) and a price to sales ratio of 0.64x. Revenue is expected to grow 7% this year and another 7% in 2015. The average analyst price target is $40.04 (2 hold ratings, 5 buy ratings, 0 sell ratings). On September 10, BMO Capital Markets raised their price target to $45 from $38 (13.35% above the current share price). One positive potential driver is the 22.95% short interest, which would take over 14 days to cover given the recent average daily volume.

Unusual Options Activity

On September 23, someone rolled out 4,801 Dec $35 calls (credit) into 7,383 Dec $40 calls (debit). The Dec $35 calls that were initially bought on August 21st for $3.10 were sold for $5.78 (86% gain in one month). On average, only 790 calls trade per day. Total call open interest is 13,149 vs total put open interest of 1,304 contracts.

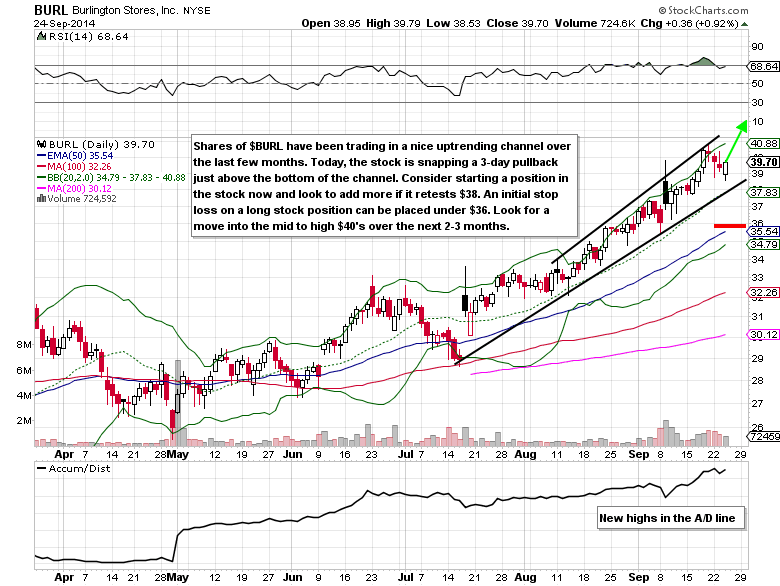

The Uptrend From The Start Of Summer Remains Intact

Burlington Stores Options Trade Idea

Buy the Dec $40/$45 call spread for a $2.00 debit or better

(Buy the Dec $40 call and sell the Dec $45 call, all in one trade)

Stop loss- None

First upside target- $4.00

Second upside target- $4.95

Disclosure: I may look to put on this options trade within the next week.

= = =

Mitchell’s Smart Money Report for unusual options activity featuring T-Mobile US (TMUS)