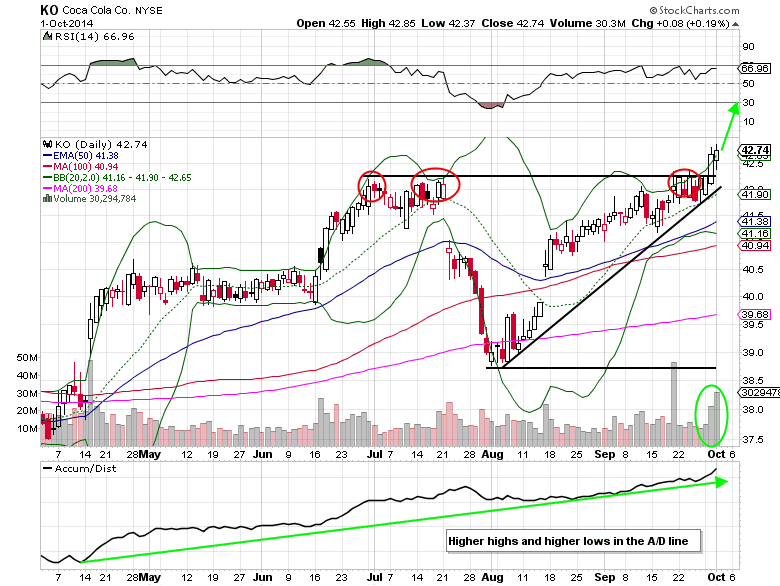

Shares of Coca-Cola (KO) are up 5.82% year to date and now starting to break out above the three month resistance level at $42.25. This breakout above the ascending triangle sets up the market for a minimum measured move to $45.75 in the coming months ($42.25-$38.75=$3.50+$42.25=$45.75). This move is also significant since it is happening on increasing volume over the last two trading days and in the face of recent market volatility.

Coca-Cola trades at a P/E ratio of 19.34x (2015 estimates) with 6.3% EPS growth (0% this year), price to sales ratio of 4.05x, and a price to book ratio of 5.49x. Revenue growth is expected to turn around from -0.7% this year to +3.8% in 2015. Despite the stock being at new highs, the 2.85% dividend remains above the SPDR S&P 500 Trust ETF’s (SPY) yield by nearly 100 basis points.

The average analyst price target is $45.27 (1 sell rating, 6 hold ratings, and 9 buy ratings). On August 18, Credit Suisse maintained their outperform rating and a $46 price target.

Unusual Options Activity

On August 28, roughly 11,000 Coca-Cola Nov $42 calls were purchased for $0.63-$0.67. This week, nearly 6,000 Dec $46 calls were bought for $0.21 each and 2,500 Jan 2016 $42 calls were bought for $2.98 each. Dr. Pepper (DPS) has saw sizable upside call buying recently too. Roughly 10,000 Nov $70 calls were purchased on September 19th with the majority going for $0.65-$0.95. Open interest in the Nov $70 calls represent 57% of total Dr. Pepper call open interest. Given the unusual options activity in both beverage companies, the rumors of a takeover of Dr. Pepper could become a reality later this year (Coca-Cola being the likely buyer).

Coca-Cola Options Trade Idea

Buy the Dec $43/$46 call spread for a $0.80 debit or better

(Buy the Dec $43 call and sell the Dec $46 call, all in one trade)

Stop loss- None

First upside target- $1.60

Second upside target- $2.90

Disclosure: I’m long shares of Coca-Cola and may buy Dr. Pepper Snapple calls soon.