Despite increased volatility in the broader market, and notable weakness in small cap stocks, the IPO market keeps churning out new deals at a rapid pace. While activity remains robust, however, the pricing and post-IPO performance for many recent deals has been less than stellar.

Travelport Worldwide (TVPT), Vivint Solar (VSLR), and Fairmount Santrol (FMSA) are just a few recent IPOs that have fallen flat since their opening debuts.

With that said, the highest-quality ones have been able to better withstand the strengthening headwinds. For instance, cyber-security company Cyber Ark (CYBR) priced its IPO above its expected range ($16 vs. $13-$15) on September 24 and is now trading roughly 85% above its IPO price. Also, although off its highs, online furniture and home furnishing company Wayfair (W) is up 12% versus its $29 IPO price – which was also above expectations.

This brings me to this week’s headliner IPO, HubSpot (HUBS), which is expected to price on October 8 and open for trading the following morning.

HUBS is a developer of a cloud-based inbound marketing platform that helps businesses attract visitors to their websites, convert these visitors to leads, and ultimately convert leads to sales. It may remind some traders of another recent IPO, Marketo (MKTO), which has been a strong performer over the past few months, up about 40% since the beginning of June.

Given MKTO’s success, and HUBS’ strong revenue growth, growing subscriber base, and improving gross margin, there should be plenty of interest, especially from the growth and momentum trading crowd. In fact, the expected price range has been bumped higher to $22-$24 from $19-$21, demonstrating that demand is indeed solid.

Closer Look At HUBS

As noted above, HUBS is the provider of a cloud-based inbound marketing platform for businesses.

As opposed to traditional marketing methods — like cold calling & email blasts — which interrupt people’s lives, inbound marketing uses a single database to collect customer activity in order to create more personalized interactions with customers. More specifically, the platform HUBS uses include applications such as social media, search engine optimization, blogging, website content management, email, CRM, analytics, and reporting.

At the core of its platform is a single inbound database for each business that captures customer activity, which is then used to create a timeline view that displays information about that customer, including how they found the company, what they’ve been clicking on, and what they have purchased in the past. One of the attractive features is that its platform has just one login, one user interface, one database, and is easy to use, designed to be used without the need for technical trading.

Even more important, though, is that the return on investment looks very appealing from a customers’ standpoint. According to HUBS, customers typically go from 100 leads per month to 570 leads per month, in a year’s time. Also, for each $1 invested in their subscription, they get an average of $4.60 back.

On the topic of its customers, HUBS focuses on selling to mid-market businesses, which it defines as businesses between 10 and 2,000 employees. HUBS generates most of its revenue from subscriptions (92%) with the remainder coming from professional services (8%).

Financial Review

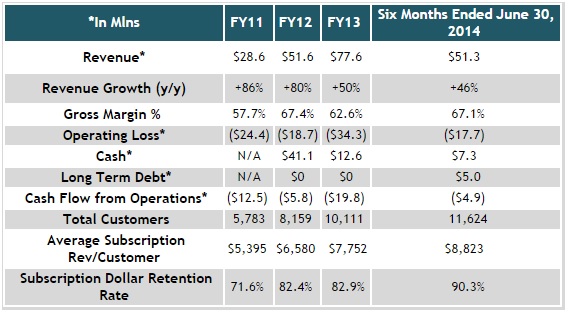

HUBS financials are a bit of a mixed bag. On the plus side, revenue growth has been solid, its gross margin is expanding, and its key user metrics are all moving in the right direction.

Not surprisingly, though, HUBS is not profitable. Furthermore, in its prospectus, the company says that it expects to increase its investments in sales and marketing as it ramps up its sales team and as it expands international operations. Therefore, it will incur losses in the near term.

Taking a closer look at its results for the six months ended June 30, 2014, revenue climbed by 46% to $51.3 million. Subscription revenue was up 48% as total customers grew to 11,624 from 8,989 a year earlier and as annualized subscription per revenue increased to $8,670 from $7,425.

Gross margin also sharply improved to 67% from 61%. HUBS attributes the improvement to better leverage in its hosting costs relative to growth in subscription revenue.

Still, operating loss widened a bit to ($17.7) million from ($16.4) million a year ago as operating expenses climbed by 38%.

Conclusion

Current conditions are certainly not ideal for any company looking to launch an IPO. With investors in a risk-averse mood, it will take a very compelling opportunity to pry them off the sidelines.

HUBS may be viewed in that light. First, its peers, MKTO and Workday (WDAY), had very successful IPOs and both have performed pretty well of late.

It’s also worth pointing out that at $23, its valuation on a P/S basis looks attractive relative to MTKO and WDAY. Specifically, HUBS’ P/S stands at 6.8x (based on annualized FY14 revenue), compared to 9.7x and 20.2x for WDAY and MKTO.

As we touched on above, revenue growth has been strong. Perhaps most encouraging is the consistent and material increases in subscription revenue per customer.

It’s not a perfect story, however, as the company is not profitable or cash flow positive at this point. But, I feel that most investors with focus on the growth opportunity rather than the bottom line and that demand should easily outstrip supply, considering that there are only 5.0 million shares involved.