The United States Oil Fund LP (USO), a crude oil ETF, is down 22.54% from the highs of 2014. This turn has taken place over the last four months amidst a rally in the PowerShares DB U.S. Dollar Index Bullish ETF (UUP) in the same time period. An end to the Fed’s Quantitative easing program and hints at a rate hike in 2015 are the likely cause for the price action we’ve seen in the U.S. dollar. Now that oil is officially in a bear market is it time to step in or is there more downside to come?

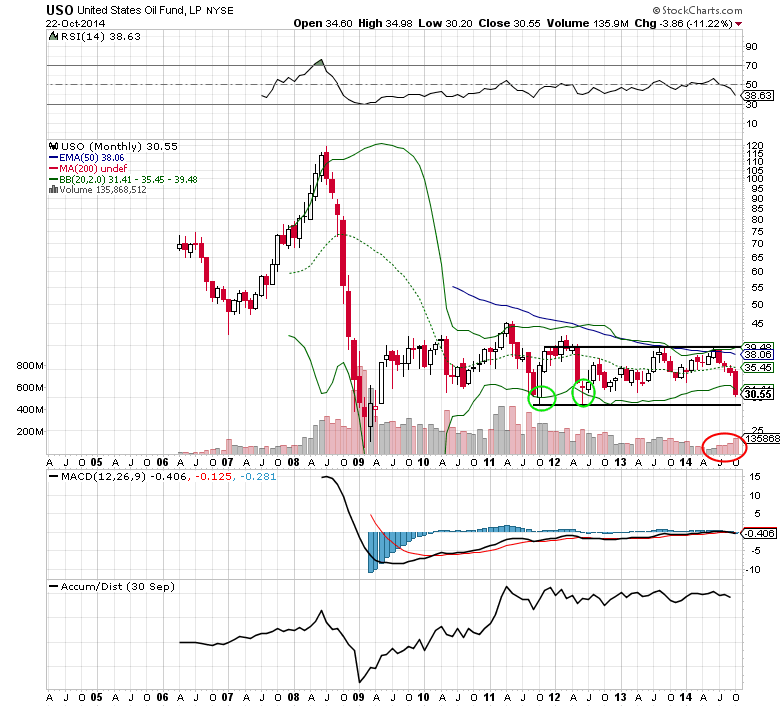

The chart shows a monthly candlestick view since the inception of the USO in 2006. For the last 3+ years it has largely been trading in a $10 range of $29-$39. The four straight months of decline (down over 11% alone this month to date) has brought the USO to lower end of the range and currently trades at $30.55. Despite the sharp selloff it still more than 4% away from retesting the major support level of $29 that held in 2011 and 2012 and is not showing signs of a reversal just yet. Another $1.50+ drop in the USO may prove to be the bottom, but the increase in volume during this weakening period for oil prices is concerning. While volume levels are down from the 2008-2011 time frame, it is worrisome for oil bulls to see a jump in trading activity as it may signal for a move below the 3 year support level. If the $29 doesn’t hold the USO may retest the low to mid $20’s levels from 2009.

For now it is best to stay on the sidelines and wait to see if buyers can put in a bottom at current support, which would be confirmed by candlestick closes similar to the 2011 and 2012 turnarounds. Sentiment on the StockTwits stream could be a good contrarian read too with bearish sentiment towards the USO at multi-month highs of 69%. However, if the USO does indeed break below the important $29 level it would be a time to consider taking a bearish position via long puts or a bear put spread to have a favorable risk/reward ratio for a move to the mid $20’s.