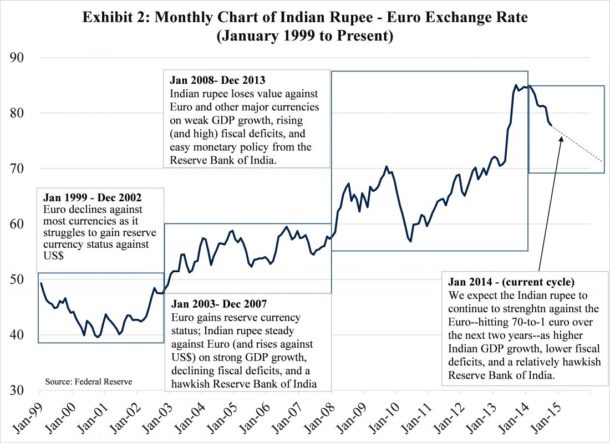

Since the beginning of this year, the Indian rupee has rallied 8% against the euro after hitting a record low of INR/Euro 85. Investors bought rupees amid a renewed confidence in the newly-elected Modi government, while selling euros, as the European Central Bank gets ready to implement its quantitative easing policy.

Our analysis suggests the INR/Euro exchange rate will rally to 70-to-1 over the next two years, from 77-to-1 today. Given this, we recommend a long position in the rupee, funded with a short position in the euro. With India’s policy rate at 8%, relative to the Eurozone’s effective rate of 0%, this translates to an annual “carry” of about 8%. Our expected appreciation of the rupee—combined with this annual carry—suggests an annual return of 11%+ over the next two years. Here are three reasons why this trade is good.

I. The euro is the funding currency of choice for the carry trade.

The carry trade involves borrowing in a low interest-rate currency to fund an investment in a high interest-rate currency. Our empirical review suggests the ideal funding currency must reside in a country or monetary union:

1) with a high and consistent current account deficit;

2) with a central bank that is monetizing its debt (i.e. quantitative easing);

3) with a central bank that is transparent;

4) with a central bank that is expected to ease, and;

5) the ideal funding currency must be overvalued.

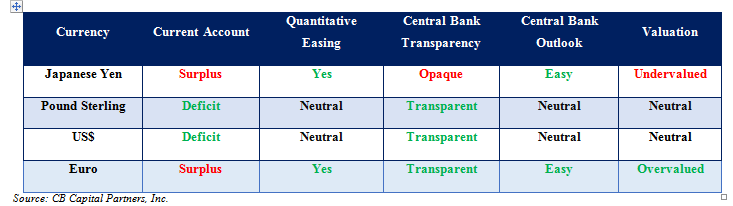

The table below suggests the euro, although not perfect, is the funding currency of choice. Our analysis of each currency follows.

Exhibit 1: The Five Essential Characteristics of a Carry Trade Funding Currency: Euro Wins

Japanese Yen

The JPY has already declined by more than 30% against the euro and US$ from peak to recent trough. The Bank of Japan (BOJ) monetary outlook remains easy, but Japan is notorious for its lack of central bank transparency. It has burned many fund managers in the past. Pass.

Pound Sterling

The Bank of England (BoE) recently reasserted its low-interest-rate policy until the middle of next year, but its quantitative easing policies are over. We are not comfortable with using the sterling as a funding currency unless the BoE provides more easing or monetary guidance. Pass.

US Dollar

The U.S. current account deficit continues to shrink, as discussed in our September 24, 2014 article. According to the Energy Information Administration (EIA), the U.S. oil-trade deficit alone shrunk to $203 billion last year, down from an annual record high of $452 billion during the third quarter of 2008. With the recent $30-a-barrel decline in oil prices and strengthening domestic production, the annual U.S. oil deficit is now just $100 billion. This means Americans are spending $350 billion less annually on purchasing foreign oil, reducing the supply of U.S. dollars by the same amount. This will put further upward pressure on the U.S. dollar. Pass.

Euro

The ECB has fallen far behind the Federal Reserve and the BoE in its monetary easing cycle, and is now expected to purchase €1 trillion in sovereign bonds and corporate bonds beginning next year. More importantly, the chance of the euro’s long-term survival is still in doubt. Consider the European banking union is encountering fierce opposition, especially from Germany. Investors are thus selling the euro; as such, the euro is our funding currency of choice.

II. Renewed investors’ confidence in India.

Confidence in India is surging as the newly-elected Modi government implements business-friendly reforms and seeks to attract foreign investments. Foreign investors are rushing in. For example, Softbank recently pledged to invest at least $10 billion in India’s e-commerce industry, beginning with a $627 million stake in Snapdeal. Softbank also led a $210 million co-investment into Ola Cabs, a digital taxi-hailing service. Flipkart, a home-grown e-commerce firm, recently raised $1 billion from firms including Tiger Global Management and Morgan Stanley Investment Management.

We believe India’s 2015 GDP growth will accelerate to nearly 7.0%, driven by the acceleration of foreign investments, as well as the recent decline in crude oil and gold prices (India’s two largest import items). Meanwhile, the Chinese economy is slowing down, while the Brazilian and Russian economies are flirting with recessions. High, unparalleled, GDP growth will be a tailwind for the Indian rupee for many months to come.

III. New leadership at the Reserve Bank of India (RBI) will provide monetary stability.

Since the RBI leadership change in September 2013, the new Governor, Raghuram Rajan, has implemented a modern, “inflation-targeting” framework versus the old, ad-hoc, and opaque methods of making central bank policy. Historically, the RBI’s monetary policy decisions have been the least predictable out of all the major central banks in the emerging markets economies.

The reason is the RBI’s historical ad-hoc approach, which took into account multiple criteria, such as growth rates, currency stability, and inflation rates. The RBI also focused on wholesale prices, which excluded the service economy, or two-thirds of India’s economy. The RBI has since shifted to a CPI measure, and it fully committed to a 6% inflation target by the end of 2015, which India should have no trouble meeting.

An inflation-targeting regime by the RBI will also result in more transparency, and, thus, more certainty and less volatile interest rates, boosting the attractiveness of the Indian rupee as an investment. Finally, a carry trade only loses attractiveness once the trade is crowded. With the Indian rupee-euro carry trade still in the early stages, we believe now is the best time to enter into a long position in the Indian rupee, funded by a short position in euros. We expect this strategy to return 11%+ annually over the next two years.

*****

Related Reading

The Euro Will Reach Parity With The U.S. Dollar In 2-3 Years: Stay Short