In a very busy week for IPOs, one deal that stands out from the pack is INC Research (INCR), a Contract Research Organization (CRO) that solely focuses on conducting Phase 1 to Phase 4 clinical trials for biopharmaceutical and medical device companies.

Its 8.1 million share IPO is expected to price on November 6 within a range of $17-$20, and then open for trading the following morning.

There are a few primary aspects to this deal that caught my attention. First, from a fundamental perspective, the company’s financials look solid, highlighted by healthy double-digit revenue growth over the first three quarters of the year. INCR is also profitable on an operating income and adjusted EBITDA basis.

Looking ahead, the future also looks bright for INCR due to the rapidly increasing amount of drugs in clinical trial stages. This burst in activity has been accentuated by a surge in pharmaceutical IPOs over the past year.

To put the opportunity into better perspective, INCR estimates that the total addressable market for CRO companies was over $56 billion in 2013, with actual outsourcing by biopharmaceutical companies to CROs at just under $21 billion.

Aside from the fundamentals, there are additional reasons to be bullish on this IPO. For instance, on November 3, LabCorp (LH) acquired fellow CRO, Covance (CVD), for $105.12, equating to a premium of about 25%. That news should further boost valuations and interest in the CRO field.

Additionally, the most recent company to go public in the CRO industry was Quintiles (Q) back in May 2013, and it has performed quite well, up 43% versus its IPO price. Those strong gains should entice prospective buyers of INCR’s deal.

Business Overview

As stated, INCR is a global CRO that solely focuses on conducting Phase 1 to Phase 4 clinical trials for biopharmaceutical and medical device companies. Along with their highly differentiated alignment and expertise, they note a specific strength in their studies surrounding the central nervous system.

The company, through its 5,500 employees in 50 countries, offers consistent and predictable clinical development services. They note that because of their scope across the globe, they have the scale to conduct any clinical trial anywhere in the world.

The company points out that 99% of their service revenues are from their clinical development services, proving their main commitment is to run and manage clinical trials on behalf of other organizations. INCR has a large customer base, featuring over 300 companies, including a number of the world’s largest biopharmaceutical companies.

Despite having several large clients that account for a fair amount of their revenues, their top five customers accounted for about 34% of their revenues in 2013. They note that no single client contributes more than 10% of INCR’s service revenues.

Financial Review

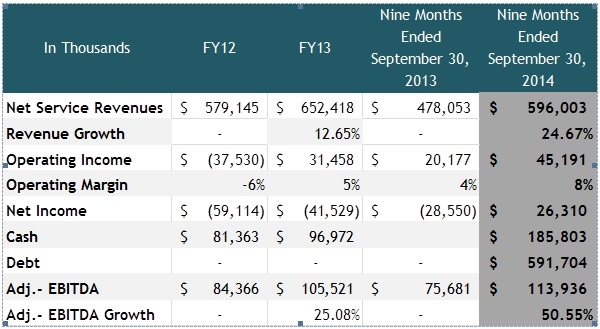

The company continues to grow at an impressive rate. For the nine months ended September 30, 2014, the company reported net service revenues of $596 million, up almost 25% from the same period in 2013. Revenues over the last three years have grown at an average of over 22%, and this year’s revenue for the first nine months already totals 91% of the entire revenue of 2013.

Based on their strong results so far this year, the company has reported net income of just under $26 million so far as gross margins improved, as opposed to a loss of almost $29 million for the same period in 2013. Worth noting, in the nine months reported for this year, the net income of $26 million includes a tax benefit of over $16.5 million as opposed to a tax loss of almost $3 million in the same period last year.

Their adjusted EBITDA reached $114 million for the nine-month period in 2014, a 51% improvement over the prior year’s adjusted EBITDA of $75.7 million. Their EBITDA margin YTD is 17.9%, vs. 16.2% in 2013, and 14.6% in 2012.

The company records new business awards into a backlog and only reports the revenues when the services are performed. For the years ended December 31, 2011, 2012, and 2013, net business awards were $449.3 million, $676.3 million and $814.2 million, respectively. Net new business for the nine months ended September 30, 2014 were $633.5 million, a 19.8% increase over the same period in the prior year.

Conclusion

INCR continues to demonstrate substantial revenue growth and has seen meaningful improvements in their margins over the past few years. INCR is also in the process of delivering their first profit since commencing initiatives to lower costs.

With the forecast for the CRO field that it will continue to grow, there is still a lot of runway for INCR as it further increases its market share. Peers in the industry have also experienced notable growth, as cash heavy biotechnology firms are progressing and outsourcing more and more drug candidates through clinical trials.

As noted above, the acquisition of CVD and Q’s strong performance since its IPO are additional positive indicators.

The one minor blemish is that the company does have a large amount of debt ($591.7 million) due to a leverage buy-out in 2010. But, in my view, the positives clearly outweigh the negatives here, making this an IPO worthy of consideration.

*****

Related Reading