Tyson Foods (TSN), a $16B food production and distribution company, announced on November 19th at the Morgan Stanley Global Consumer and Retail Conference they expect to see adjusted 2015 EPS of $3.30-$3.40 per share ($1B+ in free cash flow on $42B in revenue). The company said they are optimistic 2015 will be a record year for earnings and revenue (over $500M of sales coming from Latin America). Synergies from the Hillshire Brands deal earlier this year are expected to top $225M next year.

Using the high end of the EPS projections the stock trades at a P/E ratio of 12.70x with 15.6% EPS growth, price to sales ratio of 0.40x, and a price to book ratio of 2.24x. If revenues do in fact add $5B from this year it would be 12-13% annual growth.

On November 18th, both JPMorgan Chase and Miller Tabak raised their price target on the stock to $50. S&P Equity Research also upgraded Tyson Foods to a buy rating on the same day.

Unusual Options Activity

Less than an hour before management presented at the Morgan Stanley conference, someone purchased 2,800+ Dec $43 calls for $1.20 each ($336K in net call premium). The call to put ratio was 6:1 and call activity was three times the average daily volume. Implied volatility rose 2.8% to 26.44. He/she has a breakeven of $44.20 if the trade is held to December options expiration.

The Trade

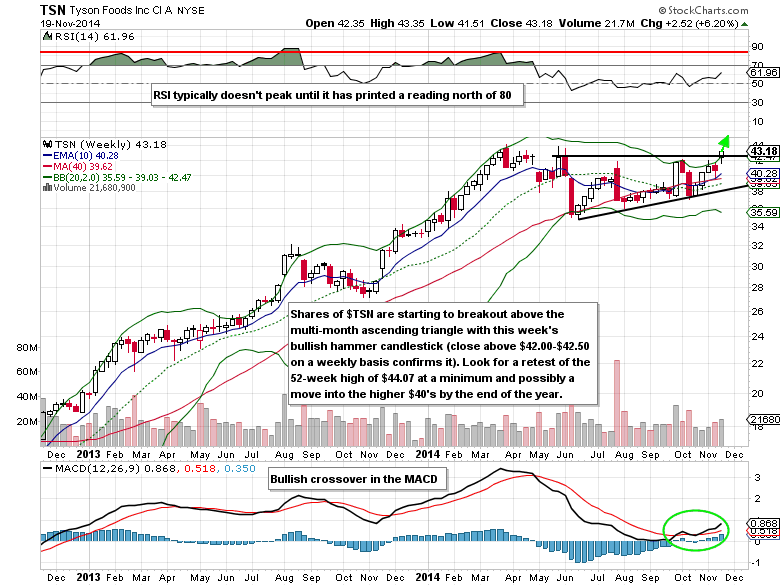

- Buy the Dec $43/$46 call spread for a $1.10 debit or better

- (Buy the Dec $43 call and sell the Dec $46 call, all in one trade)

- Stop loss- None

- 1st upside target- $2.00

- 2nd upside target- $2.9

To learn more about options trading, click here.