The recent whipsaw market has confused many traders and investors. Specifically, the rise and then fall in volatility is most puzzling. Do emotions and money swing that quickly? On the spectrum of fear/greed, the money flows back and forth like a windshield wiper, but as the markets move higher and higher, the fear of losing gains becomes more pronounced than the fear of losing out on future gains.

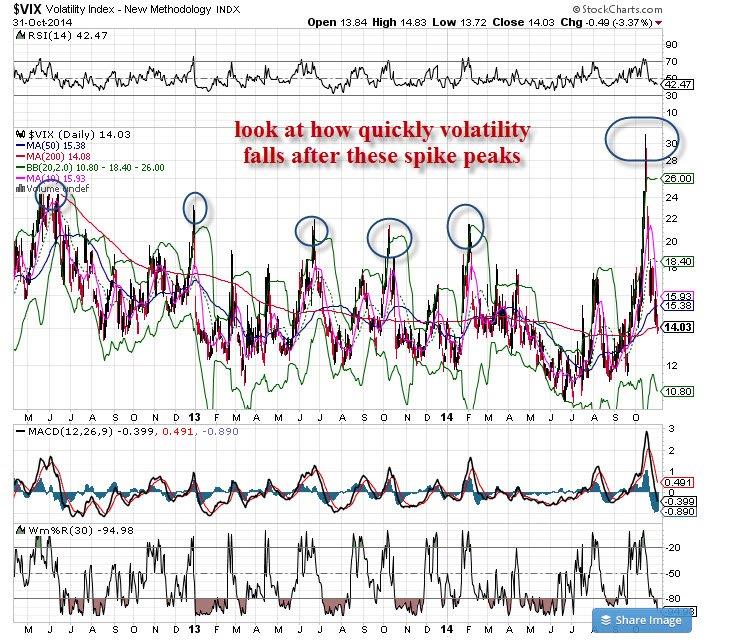

Back in mid-September, the VIX (aka the fear index) was coming in just above the yearly low (10.32), coming to rest in the 12 range; yet, a month later, we saw the VIX nearly triple to hit multi-year highs in the low 30’s.

Forward to today and we see the VIX back in the low teens once again. The stock indices reflected the change in sentiment, dropping nearly 10% on the rise in fear and then soaring 11-12% on the retreat in VIX. Was there opportunity in the fear?

There is always some chance to make money to the upside in these situations, but we must understand the context. In mid-September, the markets stood at all-time highs, volume was thin, stories about Ebola spreading were rampant, and other geopolitical threats were mounting, such as the Islamic State attacks in Syria and Iraq and Russia invading Ukraine.

In 2014, we have seen big spikes in volatility and. so far. those spikes have been great buying opportunities. Generally speaking, though, most traders and investors did not respond with the buying impulse, and that’s what is startling, if you look at past behavior patterns.

Look at the chart below and you will see what I mean. The fear of the “next” drop being “The One” to end the rally is strong and pervasive, yet that fear was proven false over and over again.

Hence, when the next ‘“scary” drop in the market occurs, remember what you did, remember what you were thinking about, what you felt, and then remember what the markets did.

Understanding your emotional response to that fear-generated market activity then just might help you take advantage of opportunity now.

#####