Scalping is a popular method for trading the Forex market and with good reason. Traders have the ability to trade as frequently as they like by opening and closing trades in seconds, meaning it can all be done even if you are working a busy schedule! If you think scalping sounds exciting, there are a few questions to ask yourself before joining the legions of traders now actively participating in the Forex market. To help you get started, today we will look at five of the most common questions and their answers. Let’s get started!

What type of trader are you?

Before you place your first trade, it is important to consider your trading style. Scalping relies heavily on technical analysis and traders will normally focus on breakouts, retracements, or ranges. Breakouts and retracements both fall into the trend trading category. Traders will look to find the markets direction and then attempt to trade with current market momentum. In an uptrend, while breakout traders will look to buy on the creation of a new high, retracement traders will only place an order after the market has pulled back or “retraced” off its peak.

Range traders take the opposite approach. Rather than trading a directional market, range traders like to initiate orders when the market is flat. This allows them to both initiate buy and sell positions on the same currency pair. All of these methodologies have their merits and once you decide on a style, it is recommended to also write down a trading plan. This will hold you accountable to your trading methodology.

What indicators should I use?

Scalpers normally use a variety of indicators to help determine their buy and sell signals. However, as you are probably aware, there are hundreds if not thousands of indicators to choose from. The good news is, if you have already decided what style of trader you are, you can quickly narrow down the field to a few select choices.

Trend traders may use a variety of trend filters such as moving averages and volatility indicators such as ATR. Breakout traders may use support and resistance indicators such as pivot points and price channels. This way orders can be initiated on a new high or low. Retracement traders often rely on oscillators such as CCI and RSI to identify overbought and oversold values. Finally, range traders may consider using a variety of the mentioned indicators. Often no indicators are needed at all, with traders electing to use price action cues to determine trading signals in flat markets.

What are the risks?

Of course there are always risks in trading. Scalpers should be more than aware of this, because trading multiple positions a day, means you may incur multiple losses. While new traders may assume scalping is riskier than other trading styles, there are steps that can be taken to help contain your risk.

One way is to control the amount of leverage that you are using in your trading. Leverage is a two way street, and it is important to realize that it has the ability to multiply gains and also multiply your losses. Since scalpers are in and out of the market quickly, it may be tempting to use an extreme amount of leverage, but it is recommend to use less than 10x leverage compared to your account size. Also, traders may consider risking 1% of their account balance or less per trade idea. This way even if one (or more) position moves against you, you will still have working capital remaining to continue trading.

What are the costs?

When trading there are always transaction costs to consider. Costs are particularly important to scalpers and day traders as you may be trading multiple times per day. This is opposed to a swing trader who looks only to take 2-3 positions a month. So what are the basic costs that scalpers are likely to encounter?

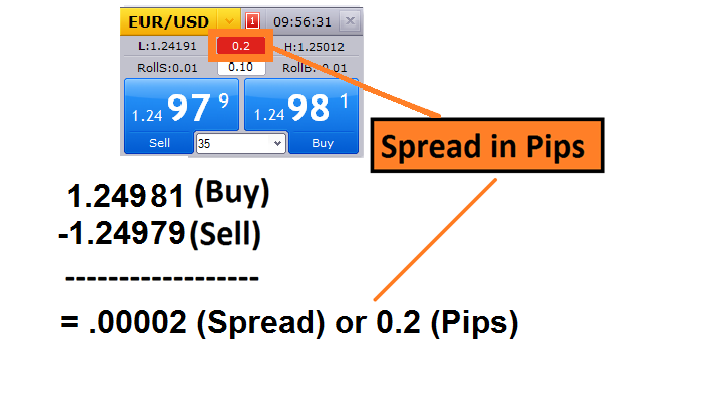

The first cost traders will incur is the spread. This is the difference between the buy and sell prices and is the reason why trades opened will start off at a small loss. Also, there is normally a transaction fee or commission attached to you trade. Commissions are normally added to your trade for compensating the broker for clearing your trade. So with this in mind, let’s look at a sample trade and the ensuing transaction costs a currency scalper may incur.

Below you will find a rate offered to traders to either buy or sell the EURUSD. With a spread of .2 pips, this means the trader will incur a spread cost of $0.20 per 10,000 units of currency transacted. Also, using FXCMs commission model, EURUSD traders will pay $0.80 round turn for their order being cleared. This equates to a total cost of about a $1.00 per 10,000 unit trade.

How do I get started?

If scalping the Forex market is right for you, the best way to get started is through a demo account. FXCM offers free demo accounts, this way you can get comfortable with the market, work on your strategy and even review the risks and costs of scalping before risking any live capital. Once you have practiced for a while, and have all of the above questions answered then you will be prepared to actively being scalping the market!

#####