The SPDR S&P 500 Trust ETF (SPY), The SPDR NADSAQ 100 ETF (QQQ) and the SPDR Dow Jones Industrial Average ETF (DIA) have rallied over the last one-two months to record highs.

Some analysts are predicting a potential meltdown because of the recent rally in the U.S markets, but looking at things from a different perspective, it appears as though the market is undergoing some price correction.

The current price levels appear well in line with the main trend. Therefore, while there could be limited upside potential at current price levels, a downside appears least likely.

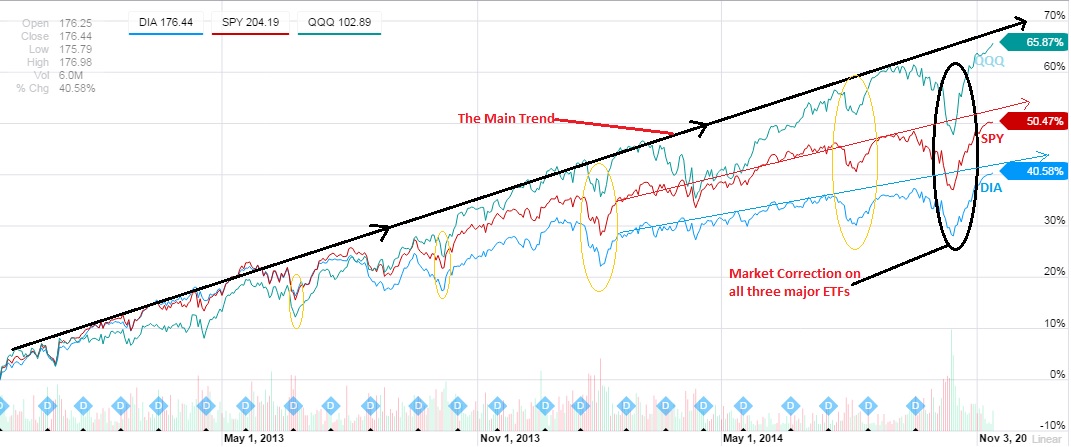

As illustrated on the chart above, in general terms, the SPDR S&P 500 Trust ETF has been on a run since last year. However, there have been several pullbacks and rebounds along the way, which have provided various opportunities for traders.

The SPY has maintained a consistent upward trending support and resistance levels, with the support suffering a few breaches, while the resistance seems to have remained steady for most of the time, before the recent breakout.

Every time a breakout has occurred, whether on the downside or upside, traders have been able to pull it back to within the trending support and resistance levels through the force of supply and demand, as well, positive earnings news from companies and positive economic data have helped, hence this suggests a market correction.

Currently, the SPY has broken out on the topside, although it is yet to establish a clear ground above the resistance level. Based on previous price movements the current level suggests that the SPY could now establish a sideways movement for a few months before making a major shift or undergoing a trend reversal.

This also coincides with activities scheduled for early next year, which include Q4 and full year 2014 economic growth, as well as dividends and earnings from the underlying index and member companies.

However, before that, investors will be monitoring the non-farm payrolls and the jobs data to weigh the outlook of the economy as the countdown to increasing interest rates continues. Therefore, this means that there could be limited movement on the SPY for the next few months, which then justifies a predictable sideways trend.

The other two major indices have followed the same trend as illustrated in the combined chart above. Interestingly, there are several dips and recoveries along the main trend happening at the same time for the three ETFs.

This also indicates that the most current rally highlighted across all the major indices and ETFs might be something similar to what the market experienced before. Therefore, basing the analysis on that experience, or, rather, what many would call back testing, the current scenario could be suggesting that the market is due to calm down.

The SPDR NASDAQ 100 ETF is up more than 65% over the last two years, while the SPDR S&P 500 Trust ETF and the SPDR Dow Jones Industrial Average ETF are up more than 50% and 40% respectively during the same period. In general, it appears that the big companies have been doing quite well over the last two years, thereby driving the valuation of the NASDAQ 100 ETF.

If the companies can continue delivering growing profits, then this would keep the current upward trend alive, at least for the next few quarters as the U.S Federal Reserve inches towards increasing interest rates.

Conclusion

The S&P 500 index is a major predictor of market movements and is often compared with several stocks to determine whether they are underperforming or over performing, in terms of return on investment.

Investors will be making various decisions subject to evaluating the S&P 500, along with the other major indices and market moving factors in the coming months, and they will be aware of the record highs reached in the last few days.

Some investors will also be weighing up the potential for a continuation of the rally, while others will be looking to pounce just in case a pullback ensues. Nonetheless, based on the overall outlook, it appears as though sideways movement is more likely than a plunge and judging by the volume of transactions, there is little to suggest that a price drop is on the way.

For more information, please click here.