When we are in an environment where traders are “All in” or “All out” and price is moving at warp speed, you have to shorten your time horizon. There are specific time periods where you can buy and hold and do very well, but, from what I am seeing, that period is gone.

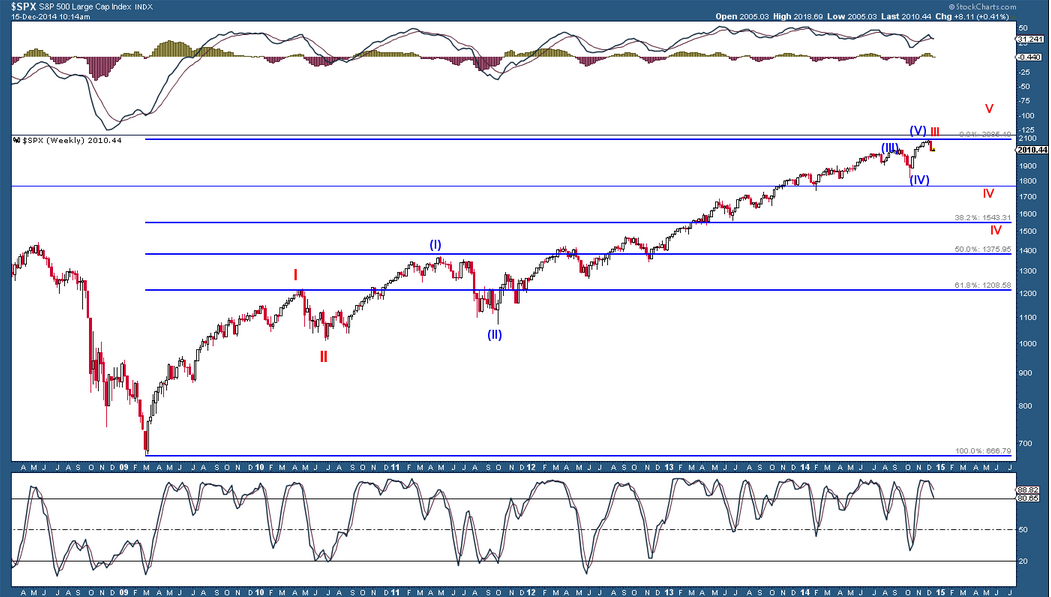

Elliot Wave (EW) counting has become very popular in the trading community. I am not going to make this an Elliot Wave article, but I will instead use EW to explain why you may have to shorten your time horizon with trades.

I am going to keep this very simple, so even if you know nothing about Elliot Wave counting, you will know exactly what I am talking about, as far as your time horizon.

In a bull market, there will always be five waves higher. The 3-Waves will always be the strongest move higher. But once that completes, things get very choppy, like we are seeing now.

I believe we finished the 3rd wave on December 8th and are now starting a Wave-4 down, which could have the SPX trading below 1600. Now even if we didn’t complete the 3rd wave and we need another push higher, we are at the back end of the move, and once it does complete (if it didn’t already) we should see the largest drop since this bull market started in 2009.

There is a chance that the expected Wave-4 could complete near the 1780 area, but that is still some 300 points off the highs. The buy and hold period has passed. Now it is time to shorten your horizon for holding onto trades. The December 8th was a turn date from a sentiment stand point, and it must be respected.

Don’t count the SPX 1540 out; it could become a reality!

#####

For more information on market sentiment and timing, please click here.