Recent economic, global and geopolitical events have put traders on edge. A plethora of negative news items have allowed the bulls to box themselves into a corner in the “wall of worry”. The good news is that the S&P 500, the stock market, and US economy are set to surge in 2015. This means that now is a good time to be looking at stocks and getting long the broad market.

Worries plaguing the market include an apparent stall in US manufacturing activity in December, a slight rise in jobless claims, plummeting oil prices, Russian sanctions, Obamacare, ISIS, and on and on. What we have to remember is that the economic trends are up and expectations going into next year are positive and making new highs. Just last week a minimum of three forward looking gauges of the economy including Moody’s Survey of Business Confidence, The National Association of Business Economists, and the National Federation of Independent Businesses reported that current conditions were a little weak, but outlook, plans, and expectations for next year remain strong and reaching new highs.

US Economy Is Gaining Momentum

The US economic recovery is by no means a raging bull. It is slowly and surely gaining traction, one sector at a time. The biggest and most significant gains are in the labor market. While there is still a long way to go in terms of wage growth and job quality, the labor market is steadily improving and gaining momentum. This is evident in every piece of major labor data you look at, and it is supported by employment components. Jobless claims, an indicator of job turnover and longer term unemployment, have been on the decline for over two year, with significant declines this year. Challenger’s survey of planned lay-offs is trending below last year’s levels and heading lower. The JOLT’s report on job openings shows that there are plenty of available jobs and that worker confidence is on the rise. ADP and NFP numbers are both trending at relative strong levels with the most recent NFP showing a surprising jump to +300K and total unemployment falling below 6%.

The steady improvement in labor is spilling over into other segments of the economy including manufacturing, retail and housing. I readily admit that none of these sectors are booming, but they are all improving and trending higher than the previous year. It would be nice to know for sure that one sector or another was booming, but in the end I think it is better that the recovery is broad. This will help alleviate bubble formation, as well as providing a strong base for next year’s growth. Plus, if small, steady growth in each sector of the economy can produce growth like we have seen this year, what kind of growth can we get when one or more of them really start expanding?

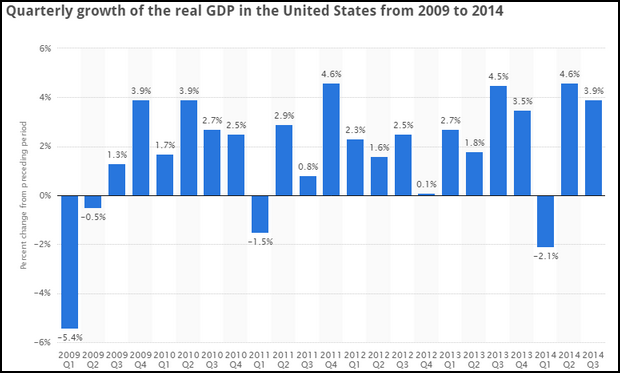

GDP is on the rise and momentum is growing. This is evidenced not only by the fact that GDP has been strong ever since the first quarter 2014 slump, but also by the trend in upward revisions to the data. Second and third quarter GDP estimates were both revised higher in subsequent estimates and will likely be revised higher again. Data released in the first two weeks of November has already sparked an increase in estimates for final 3rd quarter and first estimates for the 4th quarter. Analysts are now expecting 3rd quarter GDP to be near or above 4%, with the 4th quarter not far behind and 2015 projections have also been ramped up. Of course, it is hard to see and believe in that when there is so much negativity in the market place.

Focus on the Long-Term

From the technical perspective the S&P 500 is in a long term secular bull market. This market began at the end of 2012 when the index broke above the long term high and began its march to 2,000. There are many who doubt this but this secular bull market is driven by demographics and the shift in the labor force from the Baby Boomers to Generation X and on to the Millennials. This shift has been going on for several years and still has several more to run, if not a decade or more. Targets for the S&P 500, based on the secular break out, are up near 2,250, but that could still be years away. Until then, you should be focused on the long-term trends, the trends of rising economics, and rising stock values. Yes, S&P valuations are high, compared to recent years, but are still very low compared to historical values. Based on the assumption that we are indeed in a secular, bear market, stock values could continue to rise on a p/e basis for the next three to five years at least. This means that you should be buying the dip, whenever a dip presents itself.

#####

For more about the secular bull market and binary options from BinaryMarketAnalysis, click here