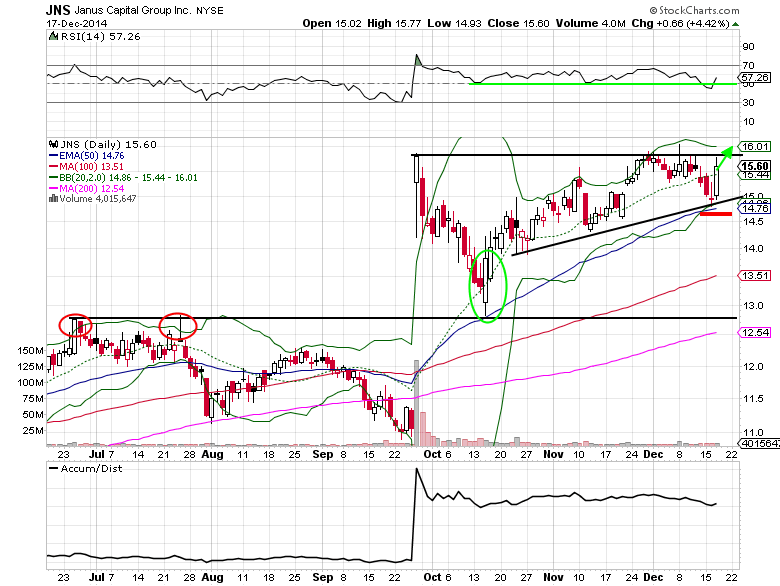

Shares of Janus Capital (JNS) are now poised to take out the Bill Gross hire level from September 26th. Less than a month after they hired the former PIMCO co-founder, the stock retested the $12.80 prior-resistance level turned support (also the 50-day exponential moving average) and has been putting in higher lows in the last two months.

If JNS shares can close above the $12.80 resistance level, it would setup for a $3 measured move to the high $18 range next year. A stop loss on a long stock position can be placed under the 50-day EMA at $14.74.

Given the massive 41% run since the close on September 25th you might think Janus Capital is overvalued or overhyped. However, looking at 2015 estimates, the stock trades at a reasonable PEG ratio of 1.03x. Revenue is expected to top $1B next year, an increase of 11.7%.

In just the first month after the Bill Gross hire, Bloomberg reported that Janus took in $1.1B in mutual fund deposits. The so-called “Bond King” is already bringing in new capital for the company and that hasn’t brought along a premium valuation for the stock just yet.

#####

To get Mitchell’s Smart Money Report for unusual options activity featuring call buying in GrubHub (GRUB), please click here.