The U.S. dollar, one of the strongest markets in 2014 and 2015, looks like it will keep the momentum rolling, or will it? Clearly, the market is off to a great start and macro economically speaking, there probably isn’t much that is going to change this in the near future. My concern with the U.S. dollar, at this point in time, concerns the rapid pace of the rally and the deteriorating internal structure of the market’s driving participants.

The U.S. Dollar Index (USD Index) is overly weighted by the Euro currency to the tune of nearly 58%. Adding the yen, the pound and the Canadian dollar to the mix accounts for more than 92% of the index. Given the circumstances of these currencies (less Canada), it’s easy to see why the U.S. dollar has been so strong. After all, the media is calling for parity with the Euro and hyperinflation in Japan.

However, major currencies rarely move too far, too fast. Governments and major corporations need time to adjust to new levels of exchange rates. I think the deteriorating internal market structure of the USD Index may be suggesting that a pause is due and, yes, I realize the USD Index is making new highs while I type.

The chink in the armor lies in the quarterly expiration cycle of the USD Index futures contract. Primary dealers and traders typically trade the front month of a futures contract because it provides the liquidity necessary to accommodate the sheer size of the positions they manage.

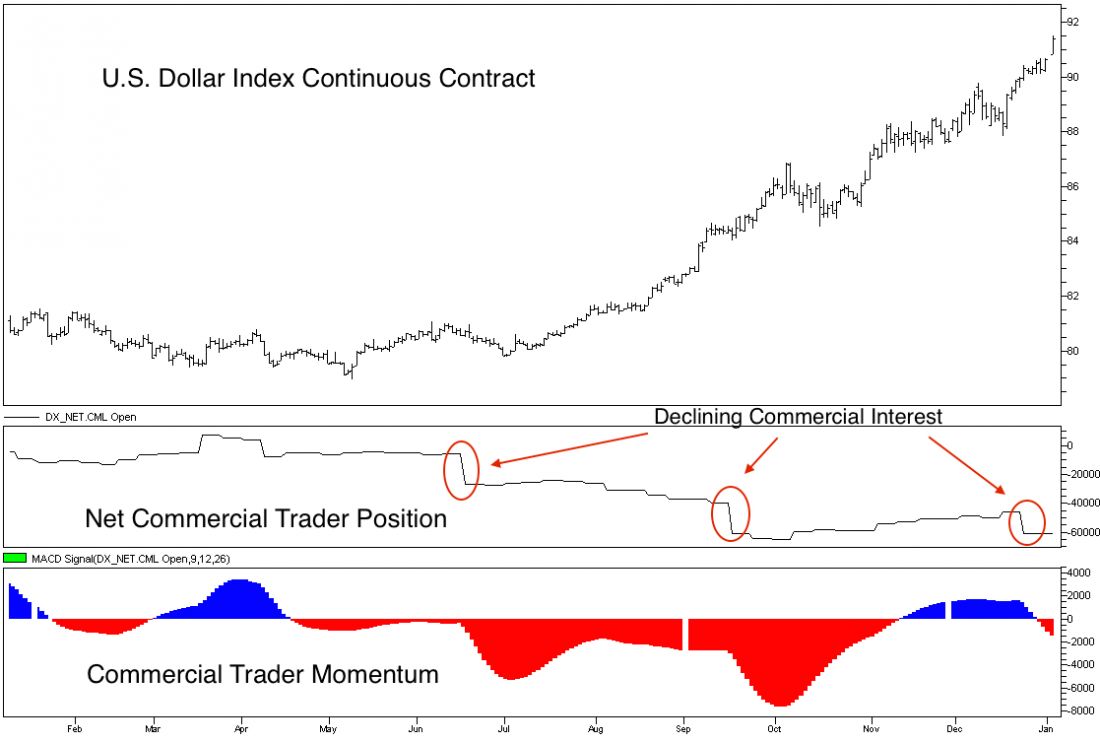

Therefore, as one quarter comes to an end, primary dealers and traders must roll their positions out to the next contract or simply offset them and remove the hedge. Looking at the chart below, it becomes clear that commercial traders have used the last three expiration cycles to lay in short hedges as the market has risen.

The real key lies in the commercial traders’ impact on the open interest totals. The USD Index rally has created a buzz loud enough to bring in the speculators from far and wide. The speculators are dead long.

Currently, open interest is above 100,000 contracts for the first time in several years. The recent commercial position is reported as net short roughly 60,000 contracts. Therefore, their growing short position, as this market has rallied, has been offset by speculative longs entering the market. Speculators can make money in the near term, but the commercial traders typically have their way in the end. The growing imbalance combined with these lofty prices suggests this market could be due for a small speculator washout in the near future.