The price of gold plunged massively over the last two years, especially during 2013 and the second half of 2014. Analysts have expressed various opinions with regard to the decline in commodity prices with some citing a waning demand, while others pointed to the U.S economic recovery.

Realistically, it is a little bit of both among other factors. Additionally, the growing investor optimism in the equities markets is not to be ignored, as well as the impressive company results posted over the last few quarters. Companies continue to deliver compelling results, especially the members of the leading indices, the S&P 500, and the NASDAQ 100.

These are some of the leading factors behind the rapid rally in the equities markets over the last few quarters. Analysts remain optimistic of the same trend continuing through 2015, but few would be keen to rule out a rebound in the price of gold.

2015 Could Be Different

- This year could be a telling one for the precious commodity, as investors seek to cushion their heavy investment in equities.

It is true in physics, what goes up must come down. Now, to be honest, that is not the nature of the financial markets. The global financial markets are structured in such a way that despite the cyclical movement between years, months and days, the overall trend continues to move upwards. In any case, that is why people invest.

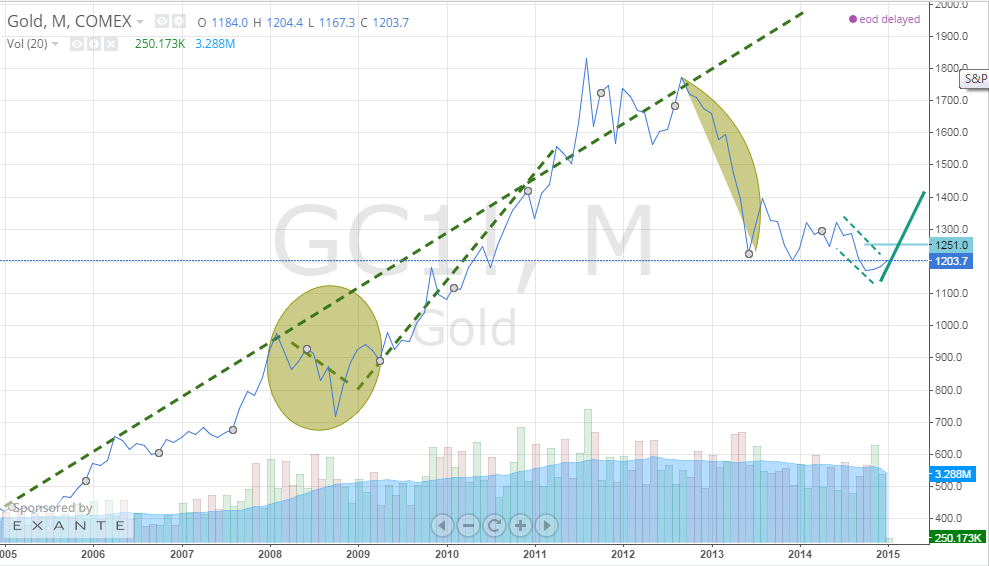

Therefore, any trend that tends to push the price of a particular asset in a continuous downward movement is deemed an abnormality. To be specific, gold has demonstrated its ability to maintain an upward movement despite periodic declines and rebounds.

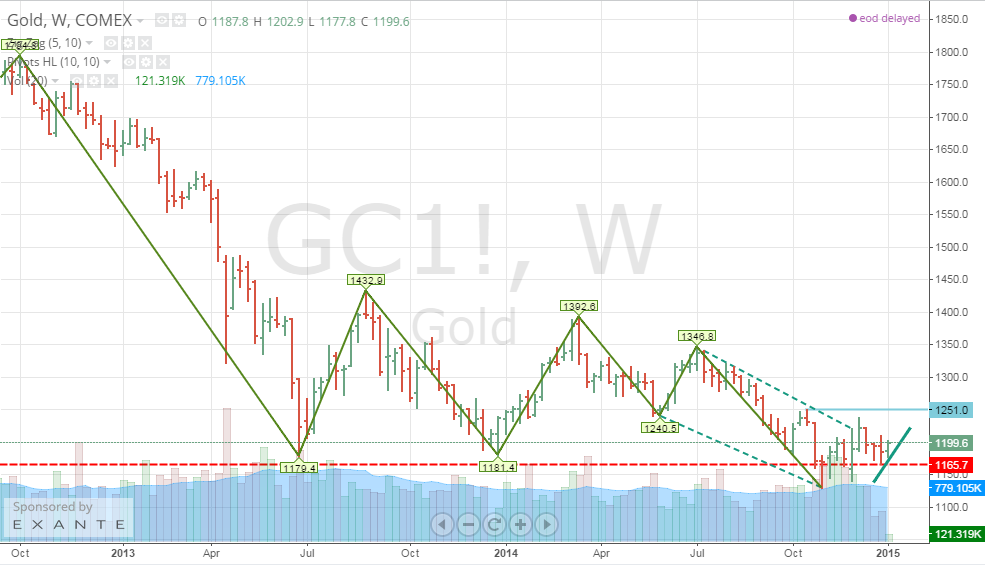

The last two or three years have seen the yellow metal’s price drop from a 2011’s high of about $1,830 to the current level of about $1,200. A look at the chart below suggests that a serious price correction could be on the horizon, which could spark a sustained uptrend in the price of gold.

The Federal Reserve Effect

- Federal Reserve must be decisive and the decision to raise interest rates needs to be made at the right time.

A delay in ticking up interest rates could cause anxiety in the market, thereby signaling more demand for gold. Therefore, the Federal Reserve will be keen to deliver on investor expectations, especially following the ending of the quantitative easing program last October.

On the other hand, an uptick in gold will be subject to serious economic challenges, including consumer demand for various products and purchasing power. Some analysts believe the current economic “picture” is unreal and does not reflect the real status of the economy.

Increasing interest rates would raise the cost of products and services, thereby putting pressure on the purchasing power of the consumer. This would in turn affect the current economic recovery trend, which could signal possible slowdown, thereby triggering demand for the yellow metal, which is considered a haven during tough economic conditions.

Therefore, if an uptick in interest rates is done prematurely, then the overall U.S economy could be come under pressure, again paving way for a bullish gold price.

Conclusion

The bottom line is the recent plunge in the price of gold has taken it to multi-year lows, which has opened a door for new investors to invest in the yellow metal.

The circumstances seem to be right, now with the U.S Federal Reserve faced with a crucial decision that could affect investor sentiment towards the equities market and investing in gold.

#####

For more information on Quantshare trading software, please click here.

Related Reading …

Gold – Stay Bearish For Now

http://www.traderplanet.com/commentaries/view/167838-gold-stay-bearish-for-now/