Aaron’s (AAN) is a $2B specialty retailer that leases and sells anything from home furniture and fridges to Dell laptops and TV’s. The stock is still recovering from a disappointing year in which earnings dropped double digits and the share price is still off about 20% from the June highs. This year is setting up to be a better year, as revenues are likely to top the $3B mark and EPS are set to grow 30% plus. AAN trades at a P/E ratio of 14.06x (2015 estimates), price to sales ratio of 0.84x, and a price to book ratio of 1.77x (all three metrics being very reasonable on a valuation basis).

Unusual Options Activity

Nearly 4,000 Feb $30 calls traded on January 7th with the vast majority being purchased for $1.50-$1.70 each. The call to put ratio was 100:1 and call activity was 72x the average daily volume. Implied volatility rose 2.2% to 33.60. Total call open interest was just 647 contracts prior to the action. Given that Q4 earnings are due out on February 5th, the big hedge fund or institution that bought the calls is likely making a bet on a strong report/FY15 guidance.

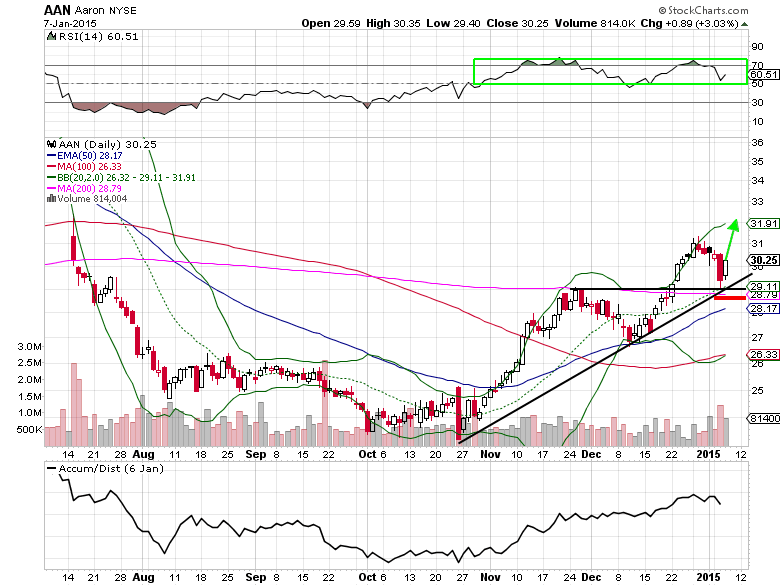

Looking at the six month daily chart above you can see that Aaron’s shares are finding support at not only the three month uptrend line, but on the new current support at $29 (prior resistance in November). This sets up for a low risk trade to the upside using a stop loss on a stock position under the 200-day simple moving average (below $29). Also, notice how the secondary indicator, relative strength index (RSI), has been moving between the 50 and 75 reading since the October bottom. This indicator can be used to know when to take profits on the trade if AAN does indeed move higher (RSI 70-75 reading).

Aaron’s Options Trade Idea

- Buy the Feb $30 call for $1.70 or better

- Stop loss- None

- 1st upside target- $32 in the underlying’s price/RSI reading of 70-75

- 2nd upside target- $4.00 in the call’s price

Disclosure: I’m long the Feb $30 calls and the stock.

To view Mitchell’s Unusual Options Activity Report featuring Valero Energy (VLO), please click here.