On January 20th, Morgan Stanley (MS) reported lighter than expected Q4 EPS and revenue, initially sending shares down 3% that morning. The company has actively been buying back shares (repurchased 8M shares in Q4 for $271M) and following an 11% dip in just three weeks, this could be another opportunity for management to put their plan to good use.

MS currently trades at a P/E ratio of 10.56x (2016 estimates) with 13.4% EPS growth, price to sales ratio of 1.99x, and a price to book ratio of 1.02x. Revenue is expected to rise 6-7% annually in the coming years. S&P Capital IQ kept its strong buy rating, even after the tepid quarterly results (12-month target of $45), seeing strength in the investment banking and wealth management.

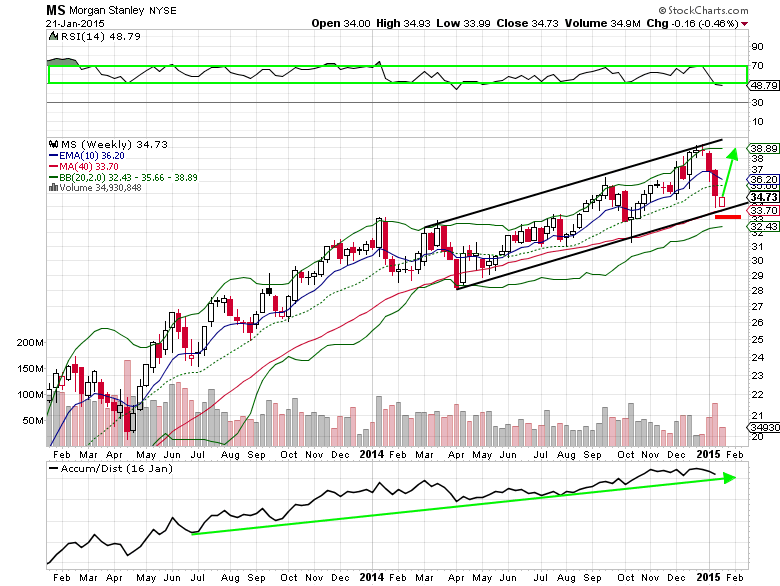

Looking at the two-year weekly chart above, we can see that MS shares have been trading in an uptrending channel for the last nine months. The recent pullback has now brought the stock back to the support at the lower end of the channel and the 40-week simple moving average (200-day simple moving average). RSI is also back near the lower end of the 50-70 range, which has typically signaled a bottomed in the underlying in the near-term. A stop loss on a long stock position can be placed just under $33 and upside to the high $30’s over the next few months.

Unusual Options Activity

On January 20th (following earnings), someone rolled out 8,000 Feb 20 $37 calls ($0.21-$0.25 credit) into 8,000 Feb 20 $35 calls ($0.78-$0.84 debit). This roll costs the large trader approximately $480K, but gives him/her a delta 0.30 higher and a lower breakeven. Also, on January 15th and 16th, there was sizable buying in the Mar 20 $37 calls for $0.75-$0.76 each. Open interest rose to 10,534 from 715 contracts.

Morgan Stanley Options Trade Idea

- Buy the Mar 20 $35/$38 bull call spread for a $1.00 debit or better

- (Buy the Mar 20 $35 call and sell the Mar 20 $38 call, all in one trade)

- Stop loss- None

- 1st upside target- $2.00

- 2nd upside target- $2.95

#####

To view Mitchell’s Unusual Options Activity Report featuring Applied Materials (AMAT), please click here.