The volatility roiling the broader markets has, at least thus far, kept a lid on the IPO market in 2015. To date, just two companies have braved the elements with County Bancorp (ICBK) and Patriot National (PN) going public on January 16.

This week, however, the IPO market will once again find itself in the spotlight as a well-known tech company makes its long-awaited debut in the public markets. Specifically, on January 22, Box, Inc. (BOX) – a provider of cloud-based storage and file sharing services – is expected to price its 12.5 million share IPO within a range of $11-$13. The lead underwriters on the deal are Morgan Stanley, Credit Suisse, JP Morgan, and BMO Capital Markets.

Ever since it filed IPO papers way back in the spring of 2014, there has been plenty of anticipation for the deal. It’s a well-known, up-and-coming cloud computing play with triple-digit revenue growth.

But, despite the likely buzz surrounding this deal, and its undeniable impressive topline growth, there are reasons to be apprehensive about this IPO. For starters, the company is bleeding red ink at an alarming rate and burning through cash rapidly. In fact, at its current cash burn rate, it would be out of cash by mid-year 2016.

Also, with Google (GOOG), Apple (AAPL), DropBox, and Amazon (AMZN) all also competing in the cloud storage space, competition is formidable, to say the least.

In short, it’s easy to envision a scenario in which BOX prices well (assuming a relatively calm market) with the stock seeing a sizable first day pop. Once the dust settles though, and investors begin focusing on a business model that may or may not pan out, it is equally easy to envision early investors flipping out of BOX, and perhaps it becoming a short-selling target depending on whether shares do see a major move higher out of the chute.

Closer Look at BOX

BOX is a provider of cloud-based storage and file sharing services, with a particular focus on the enterprise sector. Its platform helps organizations, of any size, securely manage their content and collaborate with internal and external parties.

The company has a vast customer base of 44,000 paying organizations, and 32 million registered users. Some of the best-known names include General Electric (GE) – which is in the process of a 300,000 seat roll-out – Ameriprise Financial, Gap, Eli Lilly, Schneider Electric, and Viacom.

Depending on the account type (enterprise, business, or personal) users have access to features like unlimited storage, branding, administrative controls and it can be combined with other programs such as Google apps, Salesforce.com software, and Netsuite.

BOX utilizes a “land and expand” strategy to build its customer base. It starts by offering prospective customers a free trial with a limited number of seats. Once the trial expires, it looks to sign up an initial set of seats, typically with a basic package. Then, it attempts to expand the number of seats using its service with that customer. Finally, BOX looks to up-sell the customer to a higher-priced package that was additional features.

Financials

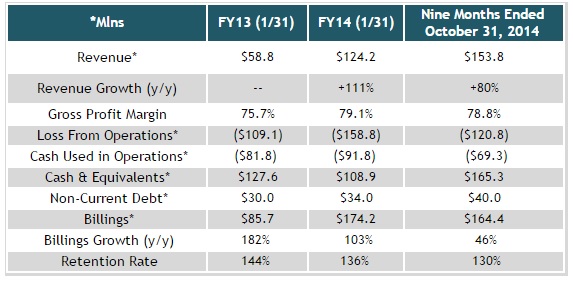

What immediately stands out about BOX’s financials are the impressive revenue growth and the huge operating losses and cash burn. So, depending on your perspective, one can make a bullish case that BOX is a younger high-growth company with plenty of room to expand, which is also not focused on the bottom line yet.

And, that is all true. With other tech IPOs in the past, I have given companies a benefit of the doubt when it comes to profitability.

In this case, I am much more hesitant to do so for a couple reasons. First, the losses are very large and are not narrowing, even as revenue growth soars. For every sales and marketing dollar spent during the nine months ended October 31, 2014, it generated just $1 of revenue. And that was good for BOX. Last fiscal year, the company only saw a return of $0.73 on each dollar spent.

The other issue we have relates to competition and the commoditization of cloud storage. Simply put, it is difficult for any one provider to distinguish itself, other than on the basis of price.

As illustrated above, revenue growth was strong at +80% for the nine months ended October 31, 2014. This was mainly driven by an increase in subscription services as the number of paying organizations grew by 47% year/year. Again, though, its operations burned nearly $92 million in cash for this period.

The good news for BOX is, it does have a healthy cash balance of $165.3 million, thanks to a private financing round last summer. Along with the upcoming IPO proceeds, BOX has enough capital to weather this cash burn for some time. But, unless it begins to see better leverage out of its sales & marketing investments, BOX figures to be losing a lot of money for the foreseeable future.

Conclusion

BOX’s exceptional revenue growth is its saving grace. The company has had considerable success winning large-scale deals with major companies (GE its latest big win) across different verticals. In order to land these tier one customers, the company uses a “land and expand” approach in which it offers its service for free for a set period of time, and for a set number of seats.

The question is this though: “Will the future revenue streams from these customers offset the massive amounts of marketing dollars spent used to sway initial potential clients away from its competitors?” So far, the answer is a resounding “no” as each marketing dollar spent is only equating to one dollar of revenue earned.

To sum it up, there could be some buzz for this IPO next week since it’s a fairly well-known company with strong growth and its deal has been anticipated for some time. Depending on market conditions, it could have a strong debut because of these factors.

From a fundamental, investment perspective though, we are not overly enthusiastic about the deal. In order to become more bullish on it, we would need to see much better leverage out of its marketing investments, allowing for it to make strides on the bottom line.