If there is one thing markets hate it is uncertainty. Yet, we find ourselves constantly in a vacuum of the unknown, and with the news flow being so quick these days (Internet and 24-hour news outlets), well there is just no time to take a breath.

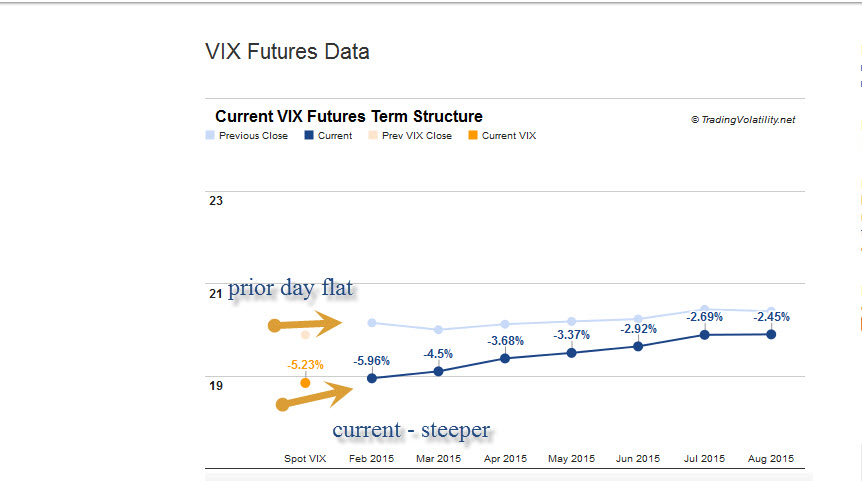

So far in 2015, we’ve seen a big rise in volatility across the VIX term structure (see chart below) as the market is pricing in more uncertainty. What is this unknown? Clearly over the last couple of years, a very generous Fed policy has created a strong appetite for risk assets. Even with the Fed’s QE ending, there is still an accommodating policy in place with near zero interest rates.

But that is not enough to remove some worry about the rest of the world, namely Europe. This is the biggest impediment to markets now, along with the strong dollar. Europe’s troubles are well documented and the market concerns are very real. Yet this week, the ECB followed through on a promise to stimulate Europe’s economy with its own QE program.

That move pushed the Swiss Bank to decouple from the Euro and other central banks cut rates over the last week (India, Canada, Denmark).

So, what does this all mean for risk assets? It’s showing up in the volatility index and term structure, where the curve is becoming more normalized for a bullish market scenario (in contango). Just earlier this week, there was a conflicting situation with a flat curve (bearish for markets). That may now be settled – and then it’s on to the next unknown!

For more from Bob Lang and Explosive Options, please click here.