On Monday (Jan. 26), we warned that US equity markets were nervous, and vulnerable to bad news. Tuesday we saw just how vulnerable. What will happen on Wednesday?

More of the same is our guess. Lots of volatility, especially around the Fed Open Market Committee minutes, which will be released at 2:00 pm.

- Despite the selling panic at the start of the day, we remain cautiously bullish.

Tuesday started off looking like the bloodbath the Bears have been longing for. The Globex futures on the Dow and the SPX large-cap index were heavily down before the US market opened – in fact, the New York Stock Exchange invoked Rule 48, which allows for a delay in opening trading in circumstances of extreme volatility.

When NYSE trading did resume, both the Dow and the SPX went straight down. At one point, the Dow was off about 500 points from Friday’s high. By 10:30 the SPX had traded down to 2020, more than 30 points below the previous day’s close.

Why?

There were as many theories explaining sell-off as there were commentators. New York City was virtually shut down in anticipation of a massive blizzard, and many traders didn’t make it in to work. U.S. macro data, especially the durable goods orders, were dismal – which didn’t prevent consumer confidence from soaring to the highest levels since 2007. Go figure. Microsoft reported a big miss on earnings and predicted more downside to come. Greek threats to leave the Euro are more convincing after the election Sunday.

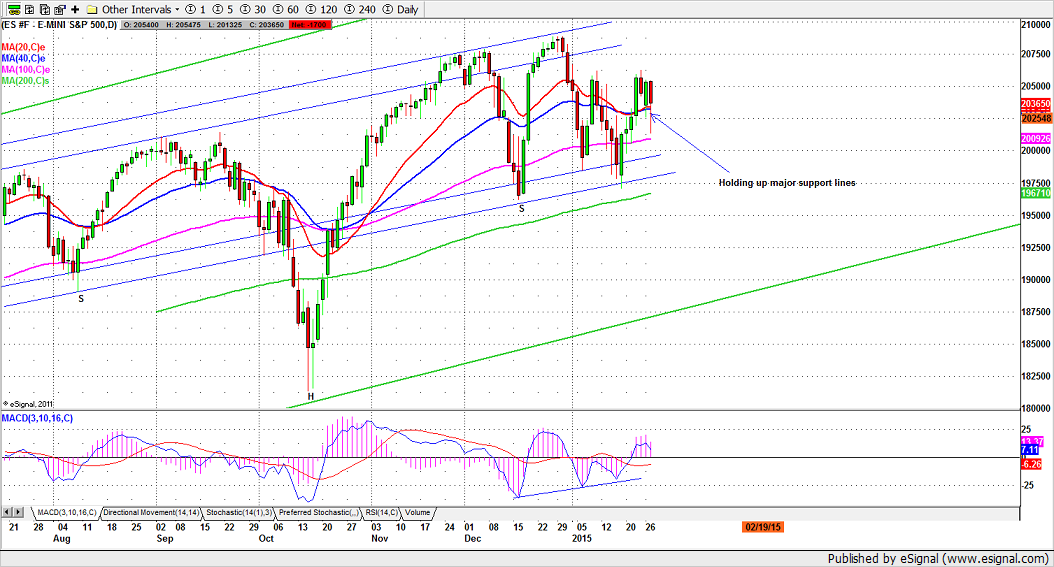

But we rely on technical analysis for our short-term outlook on the market, and two things caught our attention. The first is that the decline in the S&P futures (ESH5) stopped above the 100-day moving average line, which suggests there is support in that area. The second is that the futures clawed back up to close above the 20/40-day moving averages (see chart).

Those are both encouraging signs from a day when the damage could have been much, much worse than it was. The SPX ended the day session at 2030.39, down about 22 points from the previous close. Given the panic selling at the open that feels like a victory.

Today

For today (Wednesday Jan. 28): For the upside, 2039.50-40.50 will be the control zone. If it is broken, a move above 2044 could lead the ES back to yesterday’s Globex high at 2054.75 and fill yesterday’s unfilled gap.

For the downside, 2021.75-23.50 zone will be the control. If it is broken, a move below 2018.50 will trigger selling pressure and push the price down toward 2010.50-09.50 or lower to 2002-1998.50.

Major resistance lines: 2078-79.50, 2086.50-89, 2093.75-96.50, 2105-08;

Major support lines: 2023.50-21.75, 2015-16.50, 2010.50-09.50

S&P500 Futures: ESH5, Jan. 27, 2015

#####

Naturus.com publishes a free analysis of US equity markets each Sunday. To start receiving it, click this link.