On January 25th, CNBC’s Phil LaBeau reported that representatives of the Soros Management Fund (run by billionaire George Soros) were in California to attend the National Automobile Dealers Association’s annual meeting and they spoke with car dealer owners about possible deals. If Soros does decide to take a stake or acquire an entire dealership, this would follow Warren Buffett’s purchase of Van Tuyl Group last October (5th largest dealership in the US).

AutoNation (AN) is a $7B automotive retailer that owns more than 200 stores in the United States and offers 30+ different brands of vehicles at their locations. AN shares trade at a P/E ratio of 15.48x (2015 estimates) with 13.2% EPS growth, price to sales ratio of 0.36x, and a price to book ratio of 3.40x (6% revenue growth likely to push sales above $20B this year).

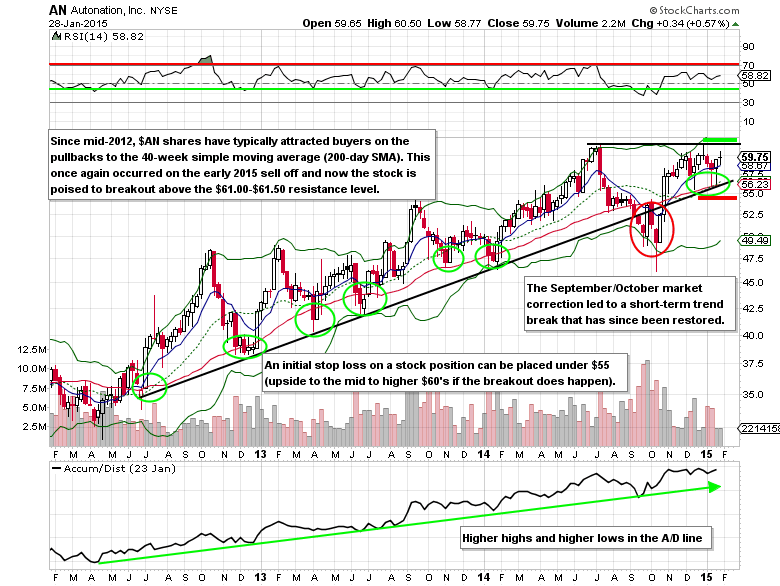

Given the fair valuation and growth coming from one of the largest automotive retailers, AutoNation could be a potential target from the likes of George Soros.

Unusual Options Activity

On January 28th, 800+ Feb $60 calls were bought for $2.30-$2.35 each and that followed a buyer of 3,000 Mar $60 calls for $2.35-$2.40 the day before. On average, just 323 calls trade per day. Q4 earnings are due out on February 3rd and the stock has had a positive response to the numbers on 4 out of the last 5 reports. This means that there are two possible catalysts in the next 1-2 months that could be the reason the sizable call buyers that have a breakeven point at $62.30-$62.40 on their options.

AutoNation Options Trade Idea

- Buy the Mar 2015 $60 call for $2.75 or better

- Stop loss- None

- 1st upside target- $5.00

- 2nd upside target- $7.00

Disclosure: I’m long the stock and the Mar 2015 $60 calls for $2.40 each.

To get Mitchell’s Unusual Options Activity Report featuring Ziopharm Oncology (ZIOP), please click here.