Looking at the companies expected to launch IPOs for the week of February 9, the steady flow of healthcare-related deals is set to march on. As many as seven IPOs from that sector could price.

However, with six healthcare IPOs delayed last week, there is certainly no guarantee this week’s set — AltheaDx (IDGX), Eyegate Pharmaceuticals (EYEG), Infraredx (REDX), AutoGenomics (AGMX), Invitae (NVTA), Bellerophon Therapeutics (BLPH), and Inotek Pharmaceuticals (ITEK) – will actually price and begin trading.

None of these companies are generating meaningful revenue at this point and investors’ enthusiasm for these clinical-stage pharmaceuticals and biotechs may finally be waning a bit.

With that said, there is one IPO this week that should see very strong interest. It’s a high growth cloud-based, data-analytics company focused on the healthcare industry. It’s also a Goldman-Morgan Stanley led deal.

Closer Look at INOV

The company is Inovalon (INOV). Its 22.2 million share IPO is expected to price on February 11, within a range of $21-$24. The lead underwriters on the deal are Goldman Sachs, Morgan Stanley, Citigroup, BofA Merrill Lynch, and UBS.

INOV is a developer of a data-driven, cloud-based platform with the purpose of improving clinical outcomes, utilization, and financial performance within the healthcare industry including health plans, hospitals, physicians, patients, pharmaceutical companies, and researchers.

Its datasets, predictive analytics, and data integration technology helps to identify gaps in care, quality, data integrity, and financial performance.

In 2014, the company provided services to more than 100 clients representing 200 patient populations, providing analytics on more than 754,000 physicians, 248,000 clinical facilities, and 120 million unique patients.

The company earns revenue through the sale or subscription licensing of its platform. Cloud-based, data-analytics-solution revenue accounted for approximately 42.3%, 45.3%, and 48.6% of consolidated revenue during the years ended December 31, 2011, 2012, and 2013, respectively. Cloud-based, data-driven, intervention-platform-services revenue accounted for approximately 57.7%, 54.7%, and 51.4% of consolidated revenue during the years ended December 31, 2011, 2012, and 2013, respectively.

INOV’s Financials

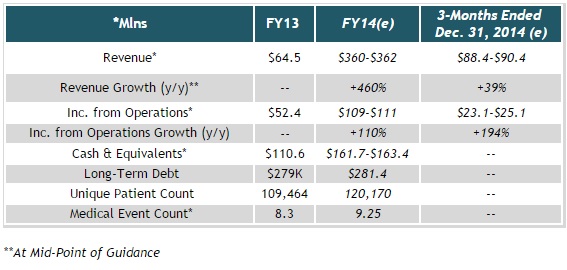

Simply put, INOV’s financials are very impressive. The topline growth in FY14 immediately jumps off the page, although its growth for the three months ended December 31 dropped sharply.

INOV is also highly profitable, and its operating income growth appears to be accelerating. If there is a small blemish, it’s that the company does have some debt on the books, but that is nit-picking.

Here is a closer look at its expected results for the three months ended, December 31, 2014.

- Revenue growth for the period is estimated to be between 37-40% with the increase primarily attributable to new clients, as well as a net increase from existing clients.

- Income from Operations is estimated to have grown by 182-207%. This was driven by the jump in revenue, and a reduced cost of revenue as a percent of revenue, due to revenue mix shifting toward more data-driven, analytical activities.

- The company credits efficiency gains through technology implementation, standardization of services, and operational process automation.

- On the balance sheet, INOV had cash & equivalents of roughly $162 million as of December 31, 2014 and total long-term debt of $281.4 million.

Conclusion

There’s a lot to like with this deal, in terms of the deal specifics and the fundamentals. The deal is led by a team of tier-one underwriters, including Goldman Sachs and Morgan Stanley. There should be more than enough demand to soak up the 22.2 million shares, paving the way for a potential deal-size/price-range increase.

INOV’s revenue growth was astounding last year and the company has plenty of room for growth ahead. More specifically, INOV estimates the market opportunity for its platform to be roughly $10.6 billion. Also, according to industry sources, the US market for software and related services is approximately $14.0 billion.

Unlike many recent IPOs, the company is already comfortably profitable. Along with the strong underwriters, the combination of high growth and profitability is a recipe for success.

The main concern we have – and it’s not a major one, yet – is its valuation. Its P/S of 9x isn’t cheap, and that is based on a share price of $22.50. If INOV prices above expectations, and then opens with a huge pop, which is entirely possible, then its valuation becomes more problematic.

#####

Related Reading