Yesterday

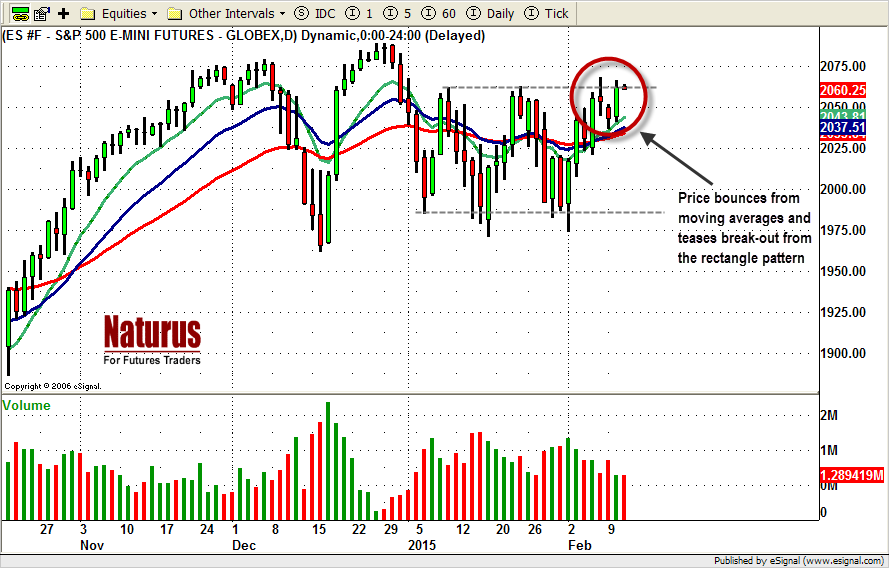

The S&P500 mini-futures (ESH5) continued their cat-and-mouse game yesterday (Tues. Feb. 10). The market has been coyly flirting with an extended rectangle pattern that marks a broad consolidation area going back to the beginning of the year.

Friday it broke out to the upside … sort of. Monday it pulled back inside the consolidation area. Tuesday it closed at 2062.25, close to the break-out point and about four points below the high of the day. Just teasing.

Most of the gain for the day came in the afternoon session, helped by rumors (later denied) of a deal resolving the Greek debt crisis. There will be more news from the debt negotiations in Brussels today, and the news may well disrupt our markets.

Today

Today we may see a gap up at the open that pushes the ES up to 2075-78 or higher up to 2083.50-85.50 (short entry) to fill the 2083.50 gap. But a quick reversal from 2085.50 should also be expected. In the past few days, we have seen some selling of big lots near the close. That doesn’t give us confidence the rally will last.

- Major support levels: 2020-18.50, 2007-09.50, 1988-86, 1975-74,

- Major resistance levels: 2066.50-68.50, 2075.50-78.50, 2085-88.50

ESH5 Feb. 10, 2015. Daily chart

#####

Naturus.com publishes a free analysis of US equity markets each Sunday. To start receiving it, click this link.