Yesterday

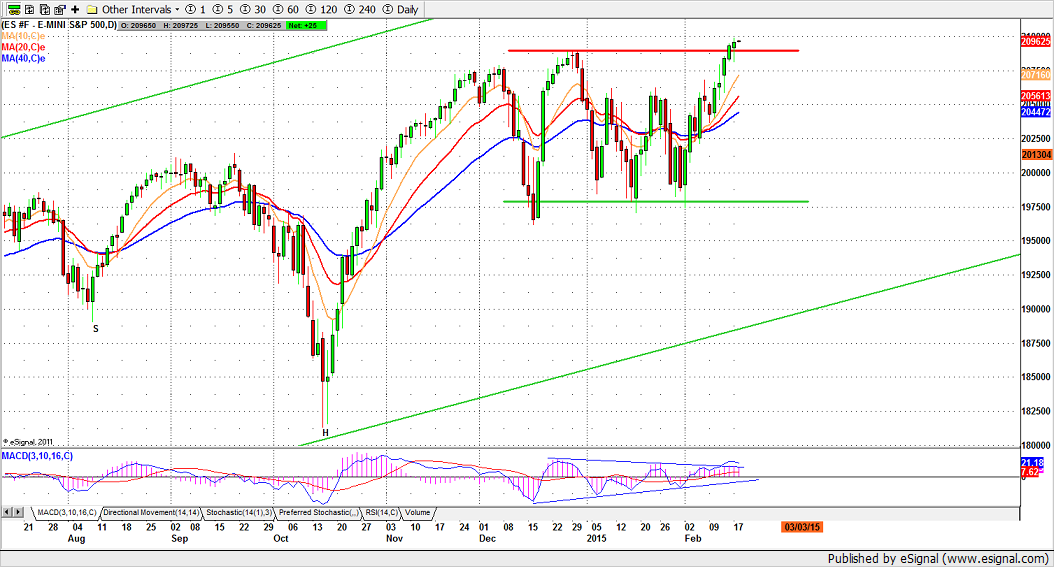

The S&P500 mini futures (ESH5) moved above the previous resistance to make a new all-time high Tuesday (Feb. 17) and closed above the resistance for a second time. That has to be seen as a break-out from the trading range that has held the large-cap futures down since the end of December. The question now is: Can it hold the gain?

The new high at 2098.75 is just below the magical 2100 level which has great psychological importance for traders. It caps a rally that has moved the market up 120 points since the beginning of February; if it holds this gain until the end of the month – or increases it – it will be the biggest monthly advance since October of 2011.

So can the market hold this gain? There is no shortage of external events contributing to the “wall of worry” markets have to scale when they make new highs. The crisis du jour is the battle over Greek debt being fought with falsehood and rumor, with each new paragraph sending the market up or down.

But the cash index (SPX) has already closed above 2100 (barely) and the market seems determined to move higher. Bad news be damned.

Today

The first issue today (Feb. 18) comes early, when the European Central Bank is supposed to decide whether or not to continue extending funding to Greek banks. The ECB is eager to promote a run on the Greek banks to increase the pressure to settle, but pulling the plug on funding could be the last straw that pushes Greece out of the Euro.

If the ECB ends funding, the ESH5 will react negatively; any decline could reach the 2088 – 2085.50 support, and perhaps move lower to 2089-75.

The next scheduled item is the FOMC minutes early in the afternoon session. Traders and the algos will be looking for any hint the Fed is weakening its stance on an interest rate increase later this year. We doubt the Fed will make any substantial change, but there may be some choppiness around the time of the release.

For the near term, the ESH5 has an over-bought condition – hardly surprising, given the steady march to the stars – and the 2100 level resistance just ahead will likely hold for a time. So, as long as the support at 2088-85.50 survives the news from Europe, we are expecting a slow, choppy advance while the market works out the over-bought condition.

If the 2100 level is breached, the advance is likely to reach the 2108-2112 area, but maybe not today.

- Major support levels: 2065-68.50, 2056.50-54, 2035-38.50

- Major resistance levels: 2105-06.50, 2111.25-12.50, 2118.50-19.50

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.