There is a famous scene in the Sherlock Holmes stories where the detective solves a complicated mystery based on one clue: the dog guarding the estate did not bark. Holmes drew the conclusion that the trespasser was known to the dog, but the wider implication is that sometimes what doesn’t happen is more important than what does.

Yesterday

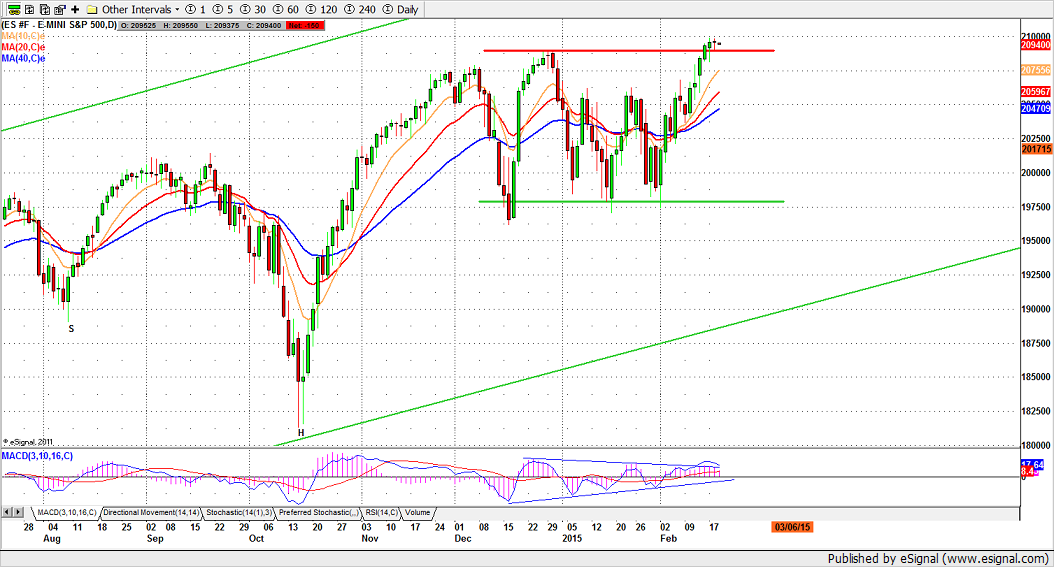

Yesterday (Feb. 18), we had an example of the dog that didn’t bark in the S&P500 mini-futures (ESH5).

There were two events we expected to affect the ESH5 trading yesterday. The first was in Europe where the European Central Bank was to make an announcement about continuing or ending funding support for Greek banks. The second was in the US equity market, where the minutes of the Fed’s Open Market Committee were to be released.

In the event, both were favorable to the market. The ECB extended funding, and the headline on the FOMC minutes showed “Many Fed Officials Inclined To Stay At Zero Longer: Minutes.”

On other days, either of those events would have boosted the market at least for the day; both together would have sent it higher. But yesterday, the dog didn’t bark. The news from Europe barely moved the needle, and while ESH5 ran up in a knee-jerk reaction to the FOMC release, it gave it all back within the hour. Only a last minute ramp-a-thon prevented the market from closing red for the day, and allowed it to close with a small weak “doji” but below Tuesday’s close. Volume was light, and the range was narrow. A little toppy, and a little scary.

Today

For today (Feb. 19), we may see some modest breakout move following yesterday’s slow grind. But there are limits on the upside, due to a short-term, over-bought condition.

The 2100 level – the psychological resistance line – may prevent the futures from advancing, and we may have to spend some time hacking at that resistance before the price can get to the 2108-12.50 zone (short entry).

But as long as there is no disturbing news from Europe, the support at 2080-75 could hold ESH5 up and encourage buyers to fight through the 2100 resistance line. For the short term, we are cautiously bullish.

- Major support levels: 2065-68.50, 2056.50-54, 2035-38.50;

- Major resistance levels: 2105-06.50, 2111.25-12.50, 2118.50-19.50

ESH5 Daily Chart, Feb. 18, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.