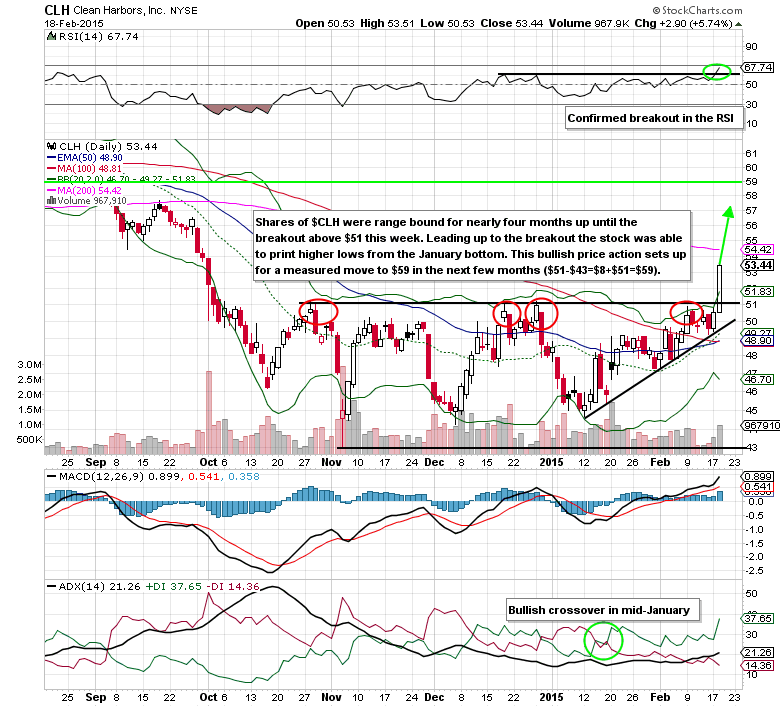

Clean Harbors is a $3B leading environmental, energy, and industrial service provider in North America. The Norwell, MA, based company has seen its share price decline more than 19% from the June 2014 high due to their exposure to the energy sector. Late last month, management decided to spin off their oil & gas field services business (could take more than a year to complete). Also, on February 4th, Clean Harbors signed an agreement to purchase Nuverra Environmental Solution’s (NES) Thermo Fluids for $85M in cash. Thermo Fluids will bolster their position in the hazardous waste disposal business (20,000 customers in 21 states).

CLH shares trade at a P/E ratio of 29.34x (2015 estimates) with 27.7% EPS growth, price to sales ratio of 0.88x, and a price to book ratio of 2.29x. Revenue is likely to finish 2014 down 3.3%, but it is expected to stabilize or grow ever so slightly this year to $3.4B.

Unusual Options Activity

On February 18th, 5,000 CLH Mar $55 calls were bought for $1.35-$1.55 each (breakeven point of $56.35-$56.55). The call to put ratio was 56:1 and call activity was 36 times the average daily volume. Implied volatility soared 6.1% to 42.23. Prior to this action there were only 1,245 in total call open interest. What makes the big call purchase interesting on top of the size is the fact that Q4 earnings come out next week on February 25th.

Clean Harbors Options Trade Idea

- Buy the Mar $55/$60 bull call spread for $1.50 or better

- Stop loss- None

- 1st upside target- $3.00

- 2nd upside target- $4.00

Disclosure: I’m long the Mar $55 calls for $1.65 each. I’ll look to take profits around $55-$56 and $59, if Clean Harbors nears that level.

#####

To read Mitchell’s post on “Two Ways To Play The Lost Luster In Michael Kors (KORS),” please click here.