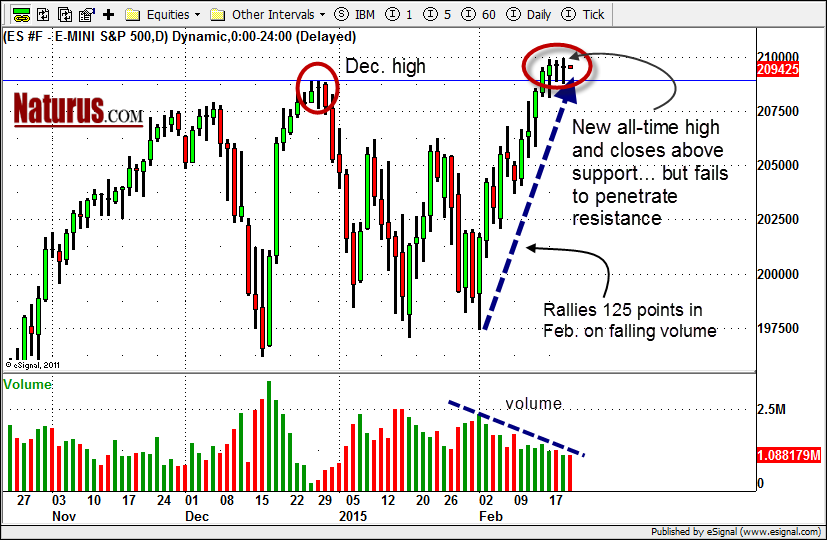

The S&P500 mini futures (ESH5) have been establishing a base near the all-time highs, preparing for a break-out move that will come in the next few days, if not today. But oh, what a wearisome process it is.

For the last three days, the futures have been grinding along in a narrow range with relatively light volume, stuck between the support level around 2086-88, and the psychological resistance at 2100. For each of those days, the market closed green for the day, if only by a couple of ticks, closed above the support, and even made new all-time highs but failed to break the resistance.

Yesterday

Yesterday (Feb. 19) it touched 2099.50 – so close! – before falling back to close at 2095.25, pushed up, as usual, by heavy buying in the last 10 minutes of trading.

Today

This kind of consolidation-area trading, where the price remains within a fairly narrow range for several days, is a bit like a spring being wound tighter and tighter. At some point the price will move decisively through the old boundaries and establish a new directional move.

The most likely direction is up, and the move is likely to start in the next few days, if not today. A break above 2100 will be bullish, and it could push the price up to 2108.00-12.50 zone (short entry).

However, a move below 2086.25 could trigger a stop run and push the price down to the 2080-75 area, but we don’t expect ESH5 will close under 2075, due to weekly options expiration day.

- Major support levels: 2065-68.50, 2056.50-54, 2035-38.50

- Major resistance levels: 2108.50-06.50, 2111.25-12.50, 2118.50-19.50

ESH5 Daily chart, Feb. 19, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.