Last Week

On Friday, to huge sighs of relief and yelps of triumph, European institutions announced a “resolution” to the ongoing saga of the Greek debt negotiations, which have become a classic drama in three acts.

The First Act was the election of a new government in Greece, vowing to repudiate the onerous agreements made by the bad old government, and they would relieve the long-suffering people of the burden of “austerity” imposed by European creditors.

The Second Act was the long, acrimonious, discussions about what to do next, with the Greeks threatening default unless the debts were either reduced or eliminated, and the creditors, led by Germany, angrily denouncing the very idea.

That act ended Friday, with the apparent triumph of the creditors and the apparent capitulation of Greece – Athens would accept a new bailout on the old terms, a course it was absolutely rejecting as little as a week ago, and the European “institutions” would extend funding for another four months, provided the Greeks return Monday Feb. 23 (today) with a satisfactory list of “reforms” they will institute immediately. Game, set, and match to the creditors. “Deutschland uber alles.”

And the Third Act? This is what will be unfolding in the next few weeks and months. It is not yet clear if it will be farce or tragedy.

Act Three contains the possibility of an ugly early surprise if the Greeks return today (Monday) with a list of reforms that is not acceptable to the Europeans. There will also be problems for some nations to ratify the agreement before the end of February, Saturday, when the current funding arrangement expires.

But in a larger sense, the agreement to extend more funding is almost irrelevant. The new bailout money won’t go to Greece (more than 90% will be used to pay interest on the existing debt) and it hardly matters if the total Greek debt increases or not. It will never be repaid, under any circumstances, because it is simply too big relative to the size of the Greek economy.

One commentator estimated that if the loans were interest-free, and if the government ran a surplus every year and used all of it to pay down the principal, it would still take about 50 years for Greece to repay the existing loans.

But the loans aren’t interest-free and the government cannot run a surplus for 50 years, and the Greek people will be laboring to pay the interest to the end of time, or the end of the current government, which is likely to be a lot sooner.

This isn’t over. If not on Monday, when Greece presents its “reforms,” or the end of June, when the new deal runs out (just before Greece has to meet a couple of large balloon payments on the old debt) then at some not-distant point in the future when Spain, or Italy, Ireland, Portugal, or Greece again repudiates a debt that is impossible to repay. The Third Act is just beginning.

This Week

US equity markets, especially the S&P 500 large-cap index (SPX), got a nice boost from Friday’s announcement of the Greek deal and broke out of the consolidation pattern it had been struggling with all week. The SPX closed at 2110.30 last Friday, up 13.31 points for a net weekly gain of 0.06%.

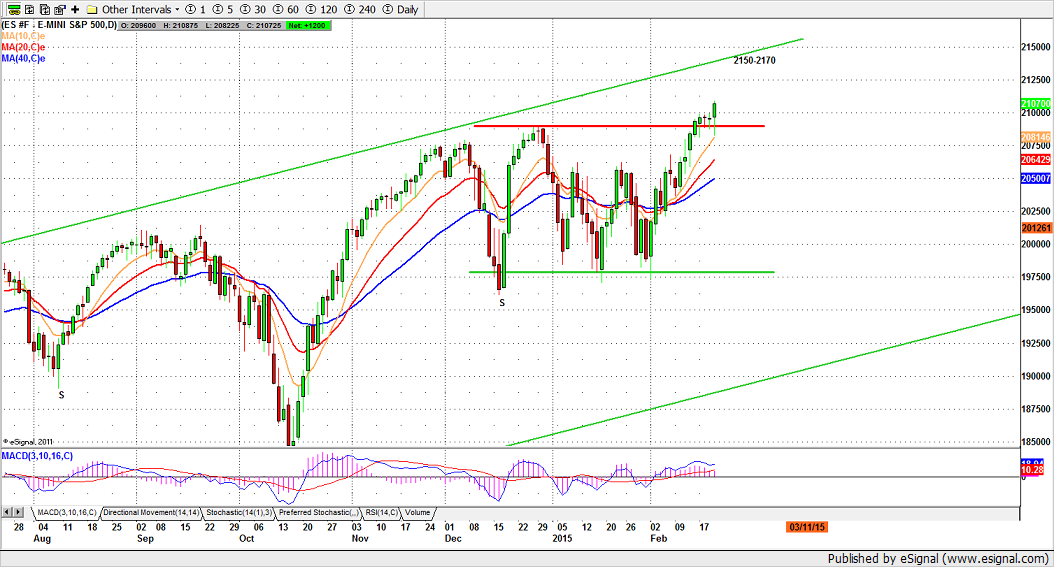

At the risk of tooting my own flute, I have to note that on Friday (Feb. 20), the index futures (ESH5) did pretty much exactly what we expected – it broke out of the consolidation area and reached our short term target above 2108.

Break-outs from consolidation frequently return to retest the break-out point, and we may see something like that happen today. However, we expect the markets to rally from this point, even if there are temporary retracements. Over the near term, we could see a 4-6% rally from the breakout.

For the mini-futures (ESH5), the 2075.50-85.50 zone should be the first support area for this week. As long as ES can manage to hold that level, the price should continue to move up until it reaches the top line (green) of the long-term resistance (See chart below.).

If news/rumors about the Greek debt or the war in Ukraine knock the ES down Sunday night and Monday pre-market, then “buying the dips” will be likely after the market opens.

Conversely, if the market gaps up on news in the pre-market trading, after the market opens, we could see some kind of retracement from whatever high is made overnight or in the first hour trading.

There is also an interesting overlap of long-term chart patterns developing in the SPX. You can see more details through the link at the end of this article. And Fed Chair Janet Yellen is speaking Tuesday and Wednesday. The Street will be watching eagerly for any hint the interest rate increase will be postponed.

- Major support levels: 2065.50-68, 2050-52, 12015-16.50, 2000-1998.50

- Major resistance levels: 2114.50-16.50, 2125-27.50, 2136.75-38.50, 2152.50-54.50

ESH5 Feb. 20, 2015. Daily Chart

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.