May cotton futures recently traded above $.65 per pound for the first time since September. Two things have happened on this rally to develop the next trading opportunity. First of all, May cotton futures traded down to $.5795 to set the low for this move one month ago. We were fortunate to see the bottom coming, as it became very clear that the commercial traders had turned to the buy side of the market prior to its trading below $.58 per/lb.

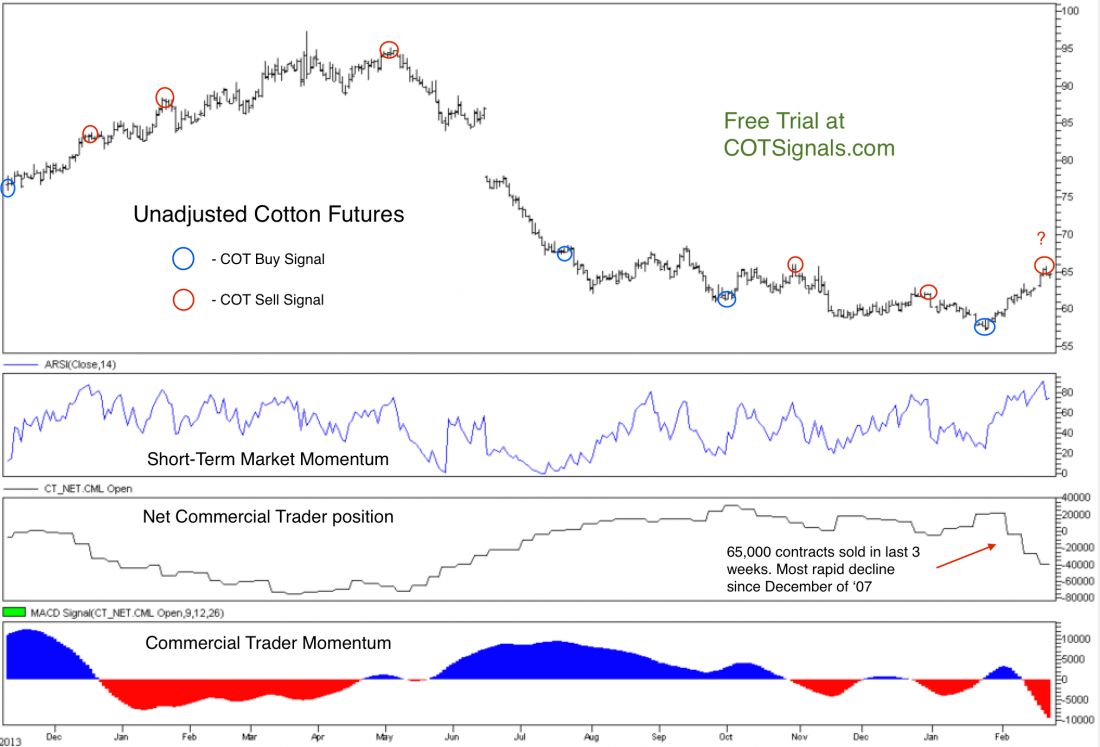

Commercial buying shifted commercial momentum to the buy side in late January, as you can see on the chart below.

This shift in momentum, combined with the oversold nature of our short-term market momentum indicator, created a classic COT Buy signal. The last additional indication of weakness on this rally off the January lows is due to the cotton futures’ open interest decline of about 15,000 contracts. The loss of about 11% of the market’s participants indicates a clear short covering rally.

The second point to be made here is the dramatic selling by the commercial traders on this rally. While we noted that their momentum had shifted to the buy side in January, their recent actions authoritatively state that this rally won’t last. Furthermore, the 65,000 contracts that the commercial traders have sold in the last three weeks represent their most aggressive selling since December of 2007. Friday’s close was still a bit too strong to drop our short-term market momentum indicator below the overbought threshold and issue an official COT Sell signal. However, today’s trade is confirming our predicted direction, and we will most likely publish the official COT Sell signal in tonight’s email.

Finally, the decline in open interest along with the dramatic commercial trader selling leads us to believe that the May cotton futures seasonal pattern and its early March peak may be materializing ahead of schedule.

#####

For more from Andy Waldcock, please click here.