With the market heading higher, and with no sign of exhaustion yet from the bulls, we do not have a reason to think anything but long.

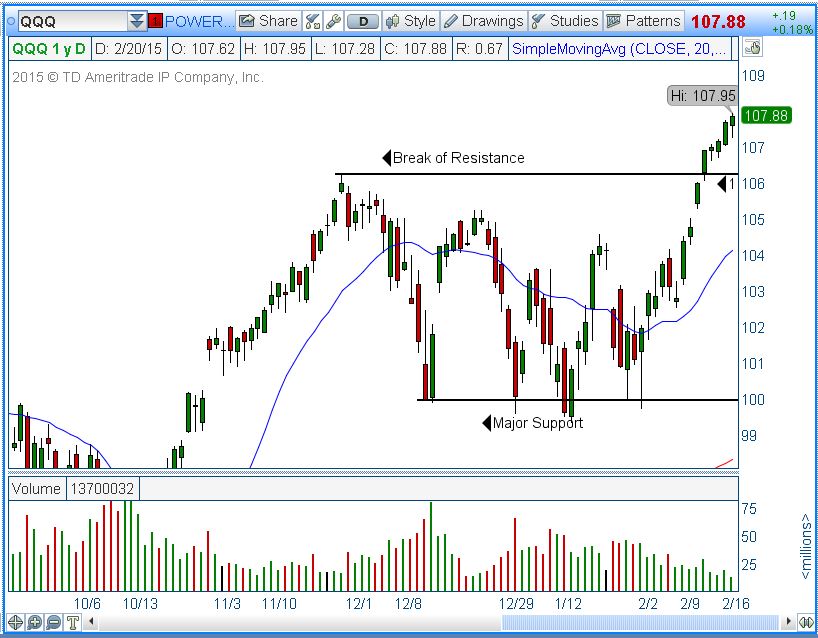

We had five consecutive positive, power-filled days for the PowerShares QQQ Trust (ETF) last week with new highs each day and the bulls still going strong into the end of the month with nine consecutive green bars on the daily chart. Moving forward, we see $106.25 area as an area of support, which means if the QQQ is to enter a correction in the near future, it is likely for it to retrace into this area.

The QQQ is still power trending on all time frames and there is no reason to think short. A short-term retracement will be in discussion if QQQ breaches $106.25. In this case, we would be looking at a wide void to fill from the wide range that the market indices called home for the last two months. See chart below.

Because we are still looking bullish, here is a trade idea for this week.

The Stock

ARWR – Arrowhead Research Corporation is a biopharmaceutical

company developing targeted RNAi therapeutics.

Technical Pattern

The stock is bottoming on large time-frame charts (daily, monthly and weekly), and the strong consolidation on the hourly chart is signaling a breakout in the making. The focal breakout area is $7.40. The stock had an abrupt drop last year, and since then, it is struggling to make the $6.00 area, its new found support and launch pad.

I will take this trade based on the hourly chart (see below). A break over $7.40 can ignite a rally into $8.50 and $10.00

The Trade

- ARWR long over $7.40

- A stop under $6.90

- Targets: $8.50, $9.30, $10.00

- Risk: $0.50

- Potential reward at ultimate target: $2.60

Technical Picture

Good trading everyone …

* Remember, as always, you should not risk your money unless you understand and are comfortable with the position and you have a full understanding of the risks of trading securities.

#####

For more information on Anka Metcalf and TradeOutLoud, please click here.