Yesterday

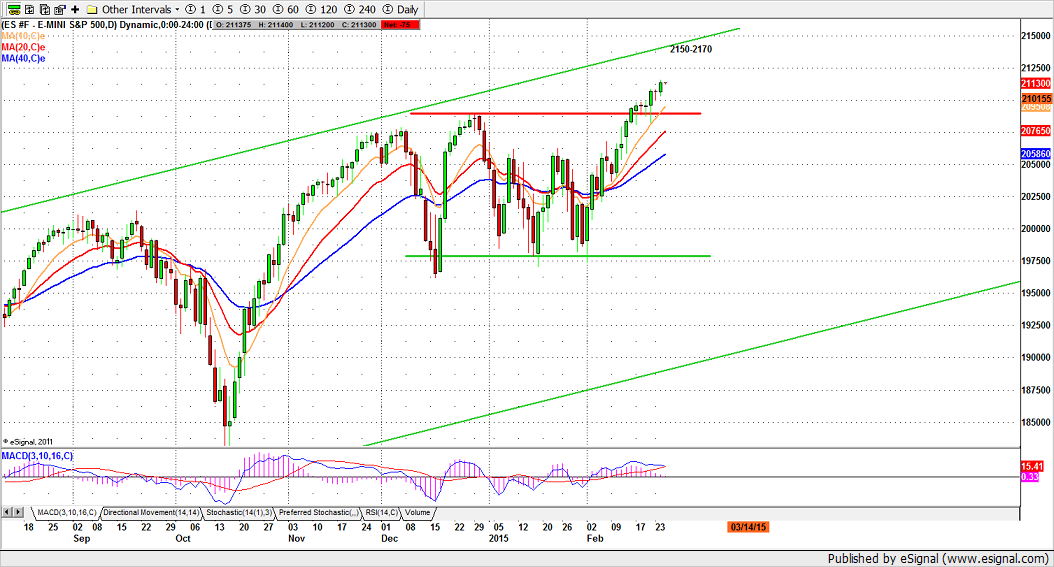

The S&P500 mini-futures (ESH5) managed to scrape up the energy to make a new all-time high yesterday and close at an all-time high. But it was a pitiful performance nonetheless. The futures closed at 2113.75, a little less than seven points above the previous close, and a little below the record high at 2115.75. The volume was abysmal, less than half the normal level. The Volatility Index (VIX) settled at 13.69, the lowest point since December 5th.

The intra-day pattern was almost exactly what we have come to expect, a ramp up into the high of the day, starting after 2:00 pm, and a pull-back at the close that is only halted by a huge bump in volume. A little less than 6% of the whole day’s volume was traded in the last five minutes yesterday. Going long, the ES at 2:00 pm has been the most consistently profitable trade this month, and the effect – as intended – has been to keep the rally alive at any cost.

Today

For Wednesday Feb. 25, the major predictable news will be the Chair of the Federal Reserve’s testimony to House. Since Ms. Yellen spoke to the Senate Tuesday, there will be little news in today’s remarks, but the Street will hear what it wants to hear, as usual. This is largely a data-free activity.

The ES is resting below the long-term resistance zone at 2125.50-33.25, and we could see some profit taking today if we reach that level. The short-term indicators are extremely overbought, and a pullback to re-test the breakout level 2088.75-84.75 is entirely possible this week or next, after the end-of-month window-dressing.

We will be looking for a gap up at the open or a run up in the price first after the market opens to see if we can find an opportunity for a decent short entry. We will be focusing on the short side today, anticipating a little ultra-short-term profit taking.

- Major support levels: 2082-84.50,2065-68.50, 2056.50-54, 2035-38.50

- Major resistance levels: 2111.25-12.50, 2118.50-19.50, 2123.50-2125.25

ESH5 Daily chart, Feb. 24, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.