Two large and unusual trades hit the tape on the ARCA exchange in Heron Therapeutics on February 24th and 25th. The Apr $12.50/$17.50 bull call spread was put on a 7,000 times for a $1.28-$1.50 debit. The breakeven point on these massive trades is between $13.78 and $14.00. Call to put ratio was 10:1 and call activity was 75 times the daily volume on February 25th. There was also a seller of 1,000 Mar $10 puts for $0.60 on the same day (another bullish trade).

Focusing on the April trades, the $337M biotech company has at least four likely catalysts that could move the stock in the next four months. Their CEO, Barry Quart, will be presenting at the Cowen and Company 35th Annual Healthcare Conference on March 4th and the 27th Annual ROTH Conference on March 9th (Q4 earnings are likely to be released around the same time as these conferences). Heron’s lead product candidate for chemotherapy-induced nausea and vomiting (CINV), SUSTOL, is expected to have an update on the potential drug in the coming months.

Heron is not yet a profitable company, but they did have more than $89M in cash at the end of September. Analysts that cover the stock are positive on the outlook of HRTX. Noble Financial and Jefferies Group have an $18 price target, $20 for JMP Securities, and Leerink Swann, Brean Capital have buy equivalent ratings as well. There is not any notable negative analyst coverage, but the stock has short interest of 6.25%.

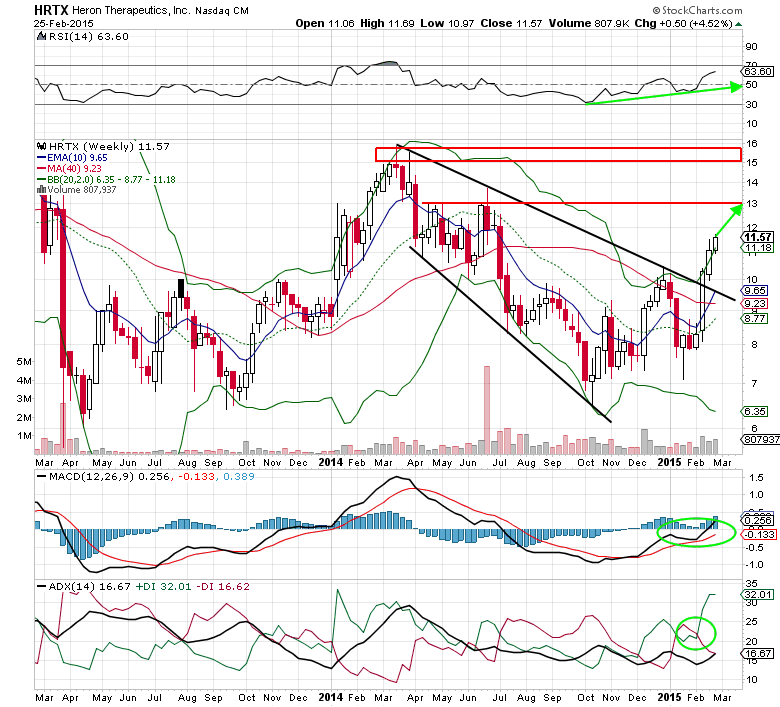

The two year weekly chart shows that HRTX shares recently broke out above the one year down-trending channel, confirmed by a bullish crossover in the ADX (w/+DI and –DI) and a positive reading in the MACD. Improving relative strength is now setting for a return to the $13 level and possibly back to $15-$16 in the next few months (a move above $14 is expected for the call spread buyers).

Heron Therapeutics Options Trade Idea

- Buy the Apr $12.50/$17.50 bull call spread for a $1.60 debit or better

- (Buy the Apr $12.50 call and sell the Apr $17.50 call, all in one trade)

- Stop loss- None

- 1st upside target- $3.00

- 2nd upside target- $4.50

Disclosure: I may buy calls or call spreads in HRTX this week.

#####

To read Mitchell’s “Why Large Option Traders Are Targeting Criteo S.A”, please click here.