Last Week

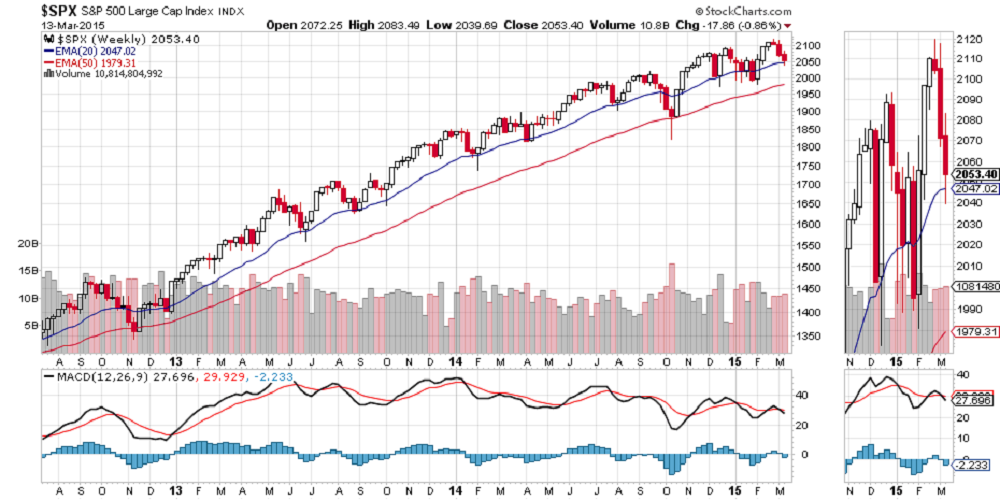

The S&P500 large-cap index (SPX) ended last week on a dismal note. It closed at 2053.40 on Friday, down 12.55 points on the day, down 17.86 for the week, and down 2.80 for the year. For the SPX, buy-and-hold has been a profitless activity in 2015.

It is the third down week in a row for the SPX, and it would have been considerably worse except for a somewhat desperate attempt to rally on Thursday (Mar. 12) to recover the losses made earlier in the week, an effort which was entirely reversed on Friday – the well-known pop-and-drop, an old trick for the SPX.

Last week’s price action could reflect the switch to the new (June) futures contract. If that were the case, then Friday’s low should hold and push the price back up to Friday’s high area or higher.

But Friday’s close was not convincing to us. It indicates the short-term trend remains down, and it could go lower than we expect if the Fed Open Market Committee statement on Wednesday (see below) suggests an early – say June – rate hike.

The Fed has promised repeatedly that there will be a rate increase at some point and there is little doubt that increasing interest rates will lead the US market into a correction. The questions are: how soon and how far?

This Week

There’s a lot to be worried about this week:

- The market volatility-index options (VIX) expire on Tuesday (Mar. 17);

- Wednesday the Fed Open Market Committee releases its minutes, to be parsed in excruciating detail for hints about an interest rate increase;

- Thursday index options expire, and;

- Friday index-future contracts expire before market opens and stock options expire at the close and two Fed governors are speaking.

Expect excitement, dramatic price swings and sharp reversals.

There is also the usual possibility of unwelcome news from Europe. The truce in the Ukraine is fraying at the edges – the Ukrainian government was required to pass legislation to reassure the breakaway provinces by last Saturday and missed the deadline – and the Greek comedy remains unresolved.

This week, 2025 will be a key line for the SPX. As long as the index stays above that level, the long-term and intermediate-term up-trends will remain intact.

However, a move below 2025 will be negative and could lead the index lower toward 2000-1975, the intermediate-term support zone. And it could go lower if it breaches the 1965 line, which would indicate the start of an intermediate term correction.

In that case, a 20% correction should be expected, which would take the market to around the 1820 level. If we do see 1820, all the upside targets we have published for this year are toast.

The S&P500 mini-futures

Note that we are now trading the June contract, ESM5.

Today 2064-67 will be the key resistance zone. Remaining under that level will lead the ES to continue moving sideways or going lower.

Alternatively, a decline and a break below 2028 will be bearish and would likely send the futures toward 2023-21 or slightly lower toward 2016.50-18.50, if there is a whiff of bad news somewhere.

If the ES holds above 2031 (last week’s low) a move back up to last Friday’s high should be expected. Tomorrow (Tues) is the $VIX option expiration; it could cause the market to have a strong price move in either/both directions.

- Major support levels: 2023-21.50, 2018-16, 2007-03

- Major resistance levels: 2062-64.50, 2088.75-89.50, 2098.50-99.50

SPX Weekly Chart, Mar. 13, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list, please click here.

HTTP://www.2.naturus.com/naturus-free-market-preview-subscription-form/