Yesterday

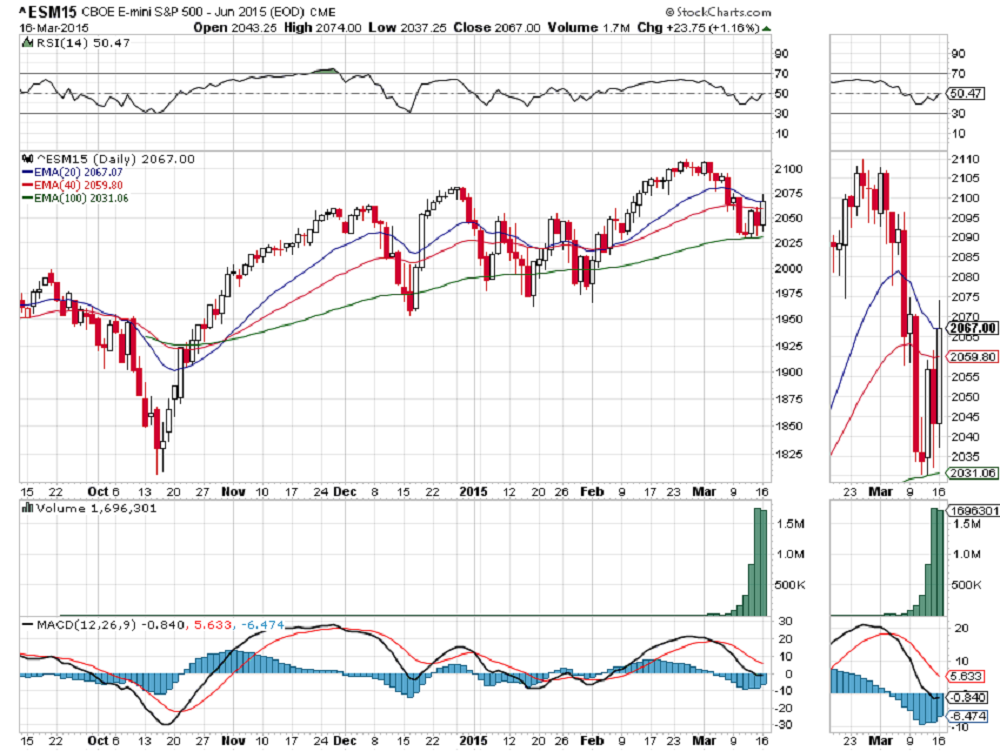

The S&P 500 mini-futures (ESM5) jumped back into the green in time for St. Patrick’s Day by gapping up at the open and staying up all day to close at 2068.50, a sold 26-point gain for the day. The futures have now retraced about 50% of the drop from the Feb. 25 high, and are back where they closed a week ago.

The price action was brisk, but the volume was below average, and the economic data released was horrid; yet still it moves.

Monday (Mar. 16) the 100-day moving average line help the price up, and the market bounced from there to test the previously broken support – the 20 and 40 exponential moving average lines. The short-term trend is still down, but we haven’t seen a short-term sell signal yet, so a snap move up is quite likely, especially coming in to the VIX option expiration today.

The Fed Open Market Committee is meeting today, and the usual rumors will be floated to push the market around. The Fed has a recent pattern of pumping liquidity into the market around option expiration. The effect is to pump the market and make Put options expire worthless, while rewarding the Bulls. And there is a potentially game-changing election in Israel today.

The week is just beginning, and, in all likelihood, the real fireworks have not started yet.

Today

Today, the 2075 line will be a key control point for any upside move and 2052.75 will serve a similar function for any possible downside move. If both key lines hold, then a sideways move between the two is in store, with the key points setting the range.

We expect a strong move, and it could be in either direction. The short-term trend is down, and will remain down unless the futures close above 2088.75. At the lower end of the range, a break below 2031 will be very negative and could trigger a sharp drop toward the 2005-10 area.

- Major support levels: 2043.50-45, 2035.50-33.50, 2028-29, 2021-23.50

- Major resistance levels: 2075.50-78.50, 2085-88.75, 2094.25-96.50

ESM5 Daily Chart, Mar. 16, 2015

#####

Naturus.com publishes a free weekly analysis of US equity indices. To get on the mailing list to receive it, please click here.