Fundamentals point to a Call Selling Opportunity in a “Back Page” Market

Last week’s strong US Employment report gave the proverbial “all clear” to the US economy and stoked speculation that interest rates are destined to increase as early as this summer. This had added extra fuel to the ongoing rally in the US Dollar. The continuing strength in the dollar has been a macro force weighing on prices of a variety of commodities in recent months.

Cocoa has been one market to buck that trend as of late. And the reason is its fundamentals.

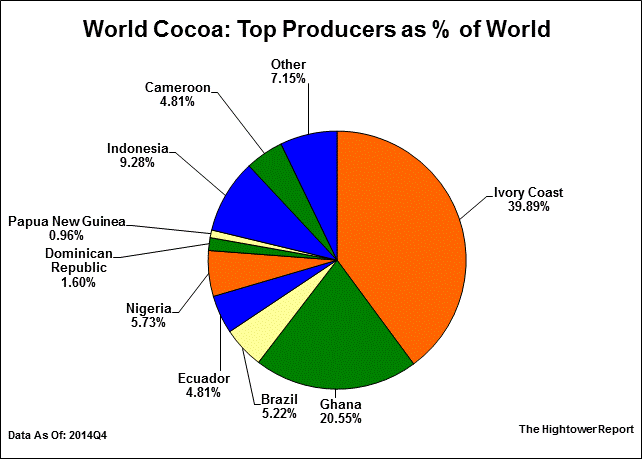

Its production is concentrated in the limited geographic area of Western Africa. In fact, Ghana and the Ivory Coast account for over 60% of the world’s cocoa production. Get a handle on the crop in those two countries and you’ve got a pretty good handle on the cocoa market.

Crop developments in this part of the world can thus have a major impact on cocoa prices.

- Global cocoa production is concentrated in Western Africa. Ghana and the Ivory Coast account for over 60% of global production.

Cocoa and the Harmattan Winds

As recently as December, the mainstream cocoa trade was expecting a small cocoa production surplus for the 2014/15 crop year. Then the dry seasonal winds known as the Harmattan winds blew down from the Sahara. This year’s version was an extremely harsh one, blanketing much of West Africa’s cocoa growing regions in dust, blocking sunlight and lowering temperatures.

As a result, yields in both Ghana and the Ivory Coast are expected to be affected. Early estimates had the Ivory Coast losing up to 10-15% of production, while Ghana could be off as much as 7.6% in 2015. The International cocoa Organization (ICCO) last month revised estimates of a surplus to a global cocoa deficit of 17,000 tonnes in 2014/15.

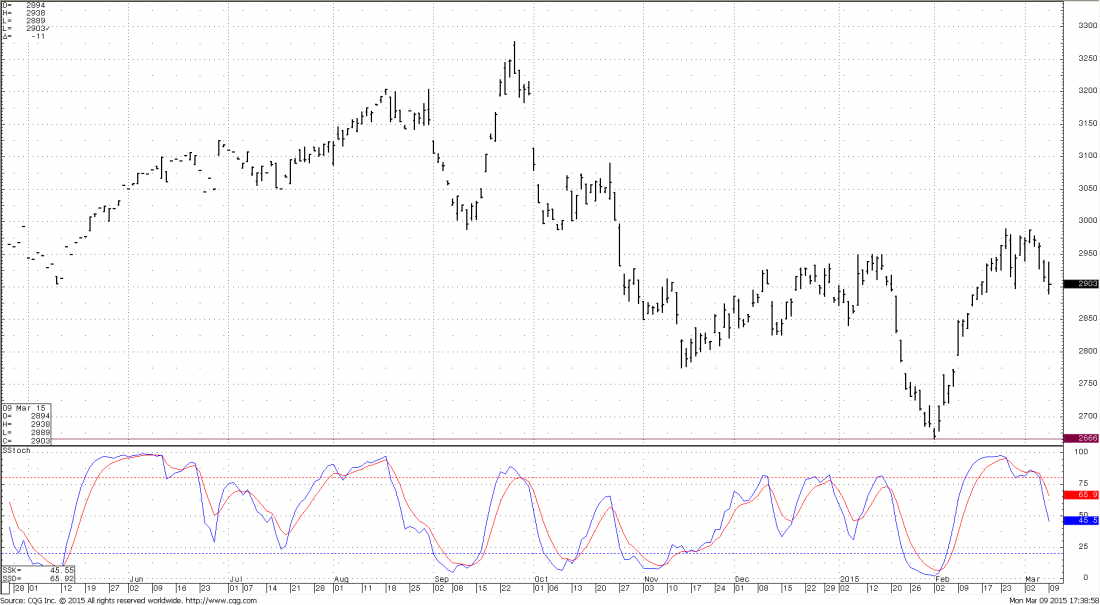

As a result, prices rallied by over $300 per ton (10.8%) during the month of February.

July 2015 Cocoa

Despite a stronger US dollar, Cocoa prices managed to rally by over 10% in February.

Time to Short Cocoa?

I never try pick tops and bottoms nor do I recommend it to any commodities investor. However, futures traders may want to seek opportunities to short cocoa as it could now be overpriced based on current fundamentals. We, of course, favor an option selling approach and will be working with our clients in implementing a call selling strategy this month.

Below are Three Reasons You May want to Consider taking a bearish stance towards Cocoa Right Now.

1. The Tendency to Overshoot

The first reason is that during market “events” (which the weather issue in West Africa could certain be considered an “event”), commodities markets tend to overshoot on the upside or downside as a “worst case scenario” seems to get priced into the market during or immediately following an event. Then, as time passes, and the true effects of the event are sorted out, the net result can (and often does) end up being less extreme than originally thought. The market must then backtrack to make up for overshoot.

This is what commodity neophytes, and even some experienced traders, fail to understand. By the time you’re reading about a market “event” in the newspaper, chances are it’s already been factored into the price. The speculators and fast buck chasers tend to get in at the end, driving the price above and beyond where fundamentals dictate it should be.

Cocoa could be in this situation at present time. Conflicting estimates from the ICCO this week are casting fresh doubts on the severity of production losses on Ghana and the Ivory Coast. In addition, the mood from cocoa buyers in Ghana has indicated that there is still “room for some recovery” with seasonal rains about to set in.

To an experienced cocoa trader, this sounds like code for “damage may have been over estimated.”

2. Main crop vs. Mid Crop

In West Africa, Cocoa beans ripen October through April, with two crops. The “main” crop, sometimes accounting for 80% of total production, is harvested by the end of March. The “mid” crop, kind of a supplementary harvest, if you will, takes place in May. By the time the Harmattan winds blew down the dust, the Main crop was already “made.” That means that any damage was likely done to the substantially smaller Mid crop – another reason early production losses could have been overestimated.

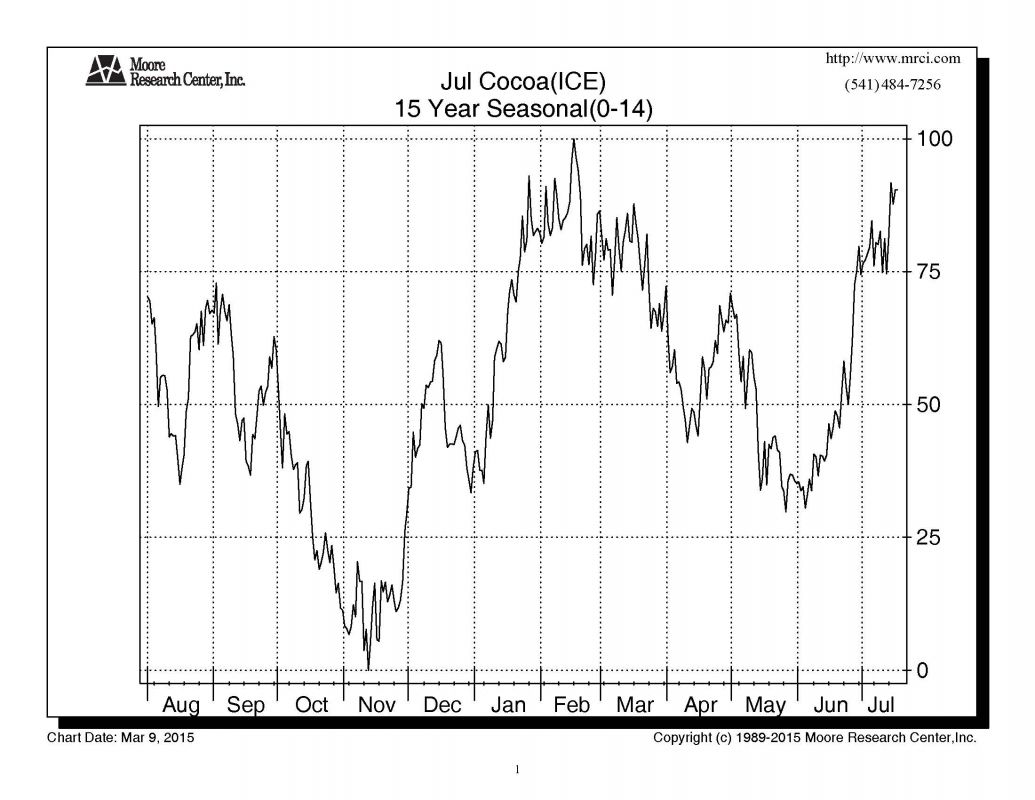

3. The Seasonal

Cocoa prices have historically tended to weaken into the heart of the March/May harvest. (Past performance not indicative of futures results)

Like many agricultural commodities, cocoa prices have historically tended to weaken during harvest. This is after all, the time that supplies will be higher than at any time during the year. As discussed above, the Main West African Cocoa harvest begins in March (in fact, it is already under way.). Thus, supplies are already heavy as the mid crop harvest begins in May.

While there is no guarantee that it will happen this year, this has historically tended to act as a bearish force for prices during this time period.

Conclusion and Strategy

While prices could see some additional volatility over the near term as the true effects of 2015 weather are realized, we feel the majority of any damage is close to being priced. A continuing strong dollar along with the factors above should, in our opinion, eventually force prices into a consolidation phase, if not a push back towards January lows.

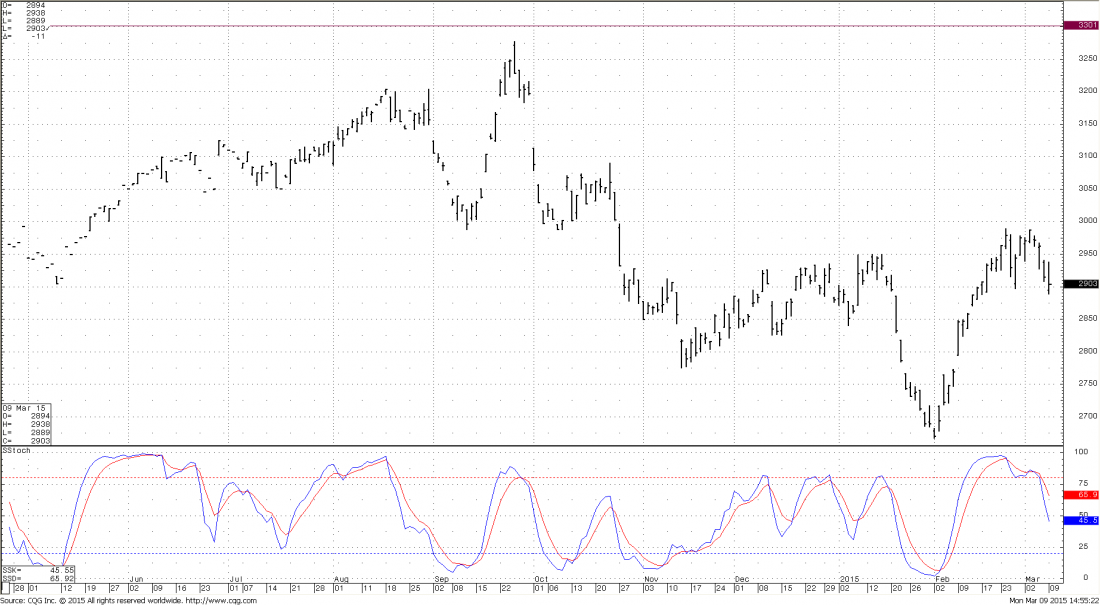

- Additional rallies in the coming weeks should be viewed as call selling opportunities.

- We like the September 3300 call as it places your position comfortably above the September 2014 price highs.

- However, we would wait for premiums to get a bit higher before pulling the trigger.

September 2015 Cocoa

- Aggressive traders can look to sell call premium on the next 1-2 day rally.

- More conservative traders can look for a slightly bigger upswing to take higher premiums.

- Current volatility should make that possible on another test of last week’s highs.

We’ll be working closely with our managed clients on premium opportunities in the Cocoa market over the next 2-4 weeks.

Have a great week of premium selling!

#####

For more from James Cordier and OptionsSellers.com, please click here.

- Price Chart Courtesy of CQG, Inc.

- Fundamental Charts courtesy of The Hightower Report

- Seasonal Chart courtesy of Moore Research, Inc

***The information in this article has been carefully compiled from sources believed to be reliable, but it’s accuracy is not guaranteed. Use it at your own risk. There is risk of loss in all trading. Past performance is not necessarily indicative of future results. Traders should read The Option Disclosure Statement before trading options and should understand the risks in option trading, including the fact that any time an option is sold, there is an unlimited risk of loss, and when an option is purchased, the entire premium is at risk. In addition, any time an option is purchased or sold, transaction costs including brokerage and exchange fees are at risk. No representation is made that any account is likely to achieve profits or losses similar to those shown, or in any amount. An account may experience different results depending on factors such as timing of trades and account size. Before trading, one should be aware that with the potential for profits, there is also potential for losses, which may be very large. All opinions expressed are current opinions and are subject to change without notice.